life insurance canada

Mortgage Life Insurance

Our broker and advisor partners work with the most well-known insurers in Quebec (see list)

How much does mortgage insurance cost in Quebec in 2025?

This is a question many Quebecers are asking, and rightly so! Every year, thousands of people take out mortgage insurance, often unaware that they're paying far more than necessary—while missing out on better options.

Why continue to pay money unnecessarily to your bank when more advantageous solutions exist?

Good news: in 2025, it’s never been easier to compare offers and find the best price for your mortgage insurance.

In the following lines, we reveal to you, using precise data, concrete examples and numerical comparisons, what mortgage insurance really costs in Quebec in 2025. You will also discover the factors that influence the price, the mistakes to avoid, and the best offers currently available on the market.

What is mortgage insurance?

Let’s start with the basics to fully understand what mortgage insurance is.

When you buy a home, you'll likely need to take out a mortgage to finance the purchase. To do this, you usually approach a bank to obtain a mortgage loan. So far, nothing too complicated.

When finalizing the loan, the bank will offer you mortgage insurance. This insurance is presented as essential: in the event of death, it would allow you to repay the loan balance.

In concrete terms, mortgage insurance is a protection that covers your mortgage if you die during the loan term. This way, the remaining balance is paid directly to the bank, preventing your spouse or loved ones from having to make the payments alone. This saves them significant financial stress.

In some cases, this insurance can also provide disability coverage by covering your monthly loan payments.

In short, mortgage insurance offered by the bank is a form of financial security linked to your home loan, sold directly by the lending institution.

However, there are also mortgage life insurance policies offered by independent insurance companies in Quebec. These options are often more advantageous, both in terms of cost and protection. We'll discuss this in more detail later.

Note: Mortgage Insurance vs. Mortgage Life Insurance

In this article, we will distinguish two important notions:mortgage insurance and themortgage life insuranceAlthough they may seem similar, they are actually two very different products. Mortgage insurance is typically offered by banks, while mortgage life insurance is offered by insurance companies. The latter has significant advantages, which we will detail in the following sections.

Why take out mortgage life insurance in Quebec?

In Quebec, mortgage life insurance fulfills the same function as mortgage insurance offered by banks: it aims to repay the balance of a mortgage in the event of death.

However, it stands out by offering more advantageous and flexible protection. Unlike bank mortgage insurance, mortgage life insurance is offered by personal insurance companies, and it allows policyholders to freely choose the desired coverage amount. It is even possible to opt for an amount higher than the mortgage amount to cover other financial needs.

According to experts, this form of insurance not only allows you to repay your mortgage, but also to:

Replacing an income in the event of death

Settle other debts

Covering death-related expenses

Another major advantage: the insurance amount remains stable over time, even if the mortgage balance decreases. Conversely, with bank mortgage insurance, the protection decreases at the same rate as the loan.

In short, mortgage life insurance represents a tailor-made solution that offers real peace of mind to Quebec families by allowing them to adjust their protection according to their needs.

Important: Is mortgage insurance mandatory?

Your bank advisor may have led you to believe that taking out mortgage insurance was essential to obtaining your loan.

But is this really the case?

The answer is no. In Quebec, it is not mandatory to take out mortgage insurance.

That said, it's generally recommended to purchase mortgage-linked life insurance. This less expensive protection can cover part or all of the mortgage balance in the event of a spouse's death. You're free to choose the amount of coverage that best suits your situation.

Why do you have to pay off a mortgage after a death?

This is a perfectly legitimate question. To understand it, simply imagine yourself in a specific situation.

Consider the example of a couple who buys a $500,000 house with a $400,000 mortgage. The monthly payments are $2,400. What happens if one of them dies? Will the surviving spouse be able to cover the payments alone? In many cases, the answer is no.

In such a situation, the bank may demand repayment of the loan or even require the sale of the house in the event of default. This is precisely the type of problem we are trying to avoid.

Mortgage life insurance helps prevent this risk. It can cover 50% of the loan balance, thus reducing the burden on the surviving spouse. Better still, it can pay off 100% of the mortgage, providing complete financial security and preventing the bereaved person from having to face an additional financial burden and manage all other expenses alone.

What is the advantage of taking out mortgage life insurance?

What are the benefits of opting for mortgage life insurance to protect your partner and your property?

Above all, it's one of the most economical and flexible solutions available on the market. Mortgage life insurance is designed to adapt to each individual's financial and personal situation.

Healthy individuals benefit from attractive premiums, while those with less health can also access excellent options that can be customized to their individual circumstances.

With that in mind, let’s discover 5 of the main benefits of mortgage life insurance:

#1: You control the amount of your coverage

With independent mortgage life insurance, you determine the amount of coverage you want, not the bank.

Conversely, with mortgage insurance offered by a bank, the insured amount automatically corresponds to the balance of your mortgage loan.

However, you may want more coverage to cover other financial obligations, provide replacement income for loved ones, or leave an inheritance.

This is entirely possible with mortgage life insurance: if your loan is $350,000, you can choose partial coverage (for example, $175,000), full protection equivalent to your balance, or even higher coverage, such as $500,000.

#2: You freely choose your beneficiary

When you take out mortgage insurance through your bank, they automatically designate themselves as the beneficiary of your policy. But is that really what you want?

With independent mortgage life insurance, you have the freedom to name the person of your choice as beneficiary. This is often your spouse, but you can also designate a child, parent, or any other person important to you.

This allows you to maintain control over the benefit's destination in the event of death. The beneficiary can then decide whether to repay the mortgage or use the funds for other purposes, as needed.

#3: A fixed premium guaranteed for the entire duration of the contract

By choosing mortgage life insurance, you know from the start the total cost of your policy for its entire term.

For example, if you opt for insurance covering the entire duration of your loan, i.e. 25 years, your monthly premium will be determined at signing and will remain the same until the end of the contract.

It won't increase, regardless of your age or health status. This makes it easy to plan your budget. If your premium is set at $35 per month, you'll pay exactly that amount for 25 years, with no surprises.

#4: Stable coverage that doesn't decrease with your loan balance

One of the main advantages of independent mortgage life insurance is that your coverage amount remains fixed, regardless of how your mortgage balance changes.

With bank mortgage insurance, coverage decreases as you repay your loan. Yet, you continue to pay the same premium. For example, an initial $400,000 policy at $40 per month could amount to only $210,000 of protection after 15 years—while still costing you $40 per month.

With bank mortgage insurance, coverage decreases as you repay your loan. Yet, you continue to pay the same premium. For example, an initial $400,000 policy at $40 per month could amount to only $210,000 of protection after 15 years—while still costing you $40 per month.

This is a considerable advantage: in the event of death, your beneficiaries receive a benefit much higher than what remains to be repaid on the mortgage.

#5: Your insurance follows you, even if you change banks

Taking out mortgage insurance with your bank can quickly become a hassle. If you decide to switch lenders later, you'll be forced to cancel the insurance—which can be problematic.

In 10 years, will you still be insured if you change banks? Nothing is guaranteed, especially if your health has changed in the meantime.

This is where one of the great advantages of independent mortgage life insurance comes in: it is not tied to your financial institution.

Your contract is with a private insurance company, which means that no matter which bank you choose for your loan, your coverage remains intact. You are therefore free to change lenders without risking losing your protection.

To receive a FREE quote tailored to your current situation,

Simply fill out the form on this page. A partner broker will contact you (click the button below).

What is the cost of mortgage life insurance in Quebec in 2025?

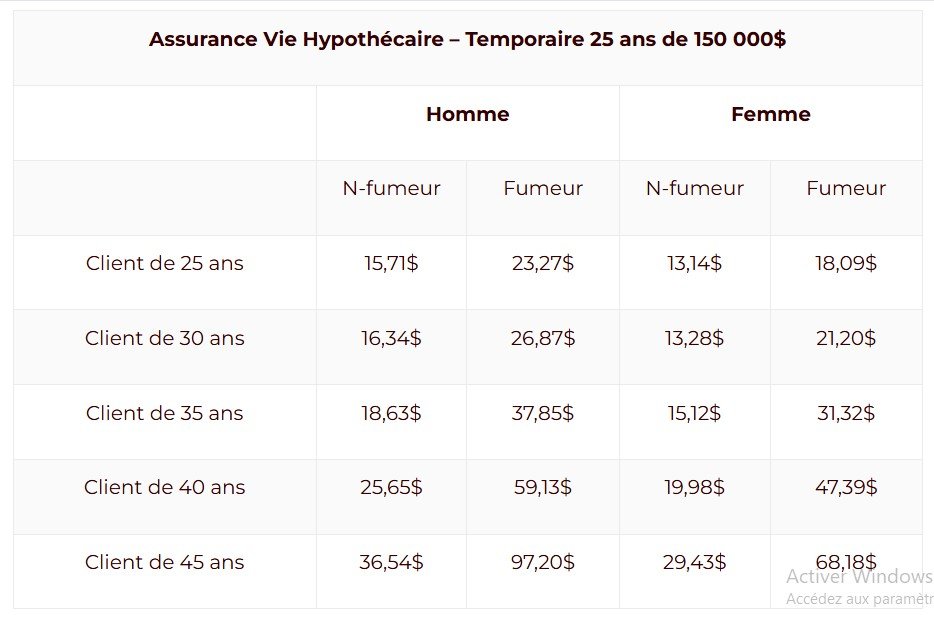

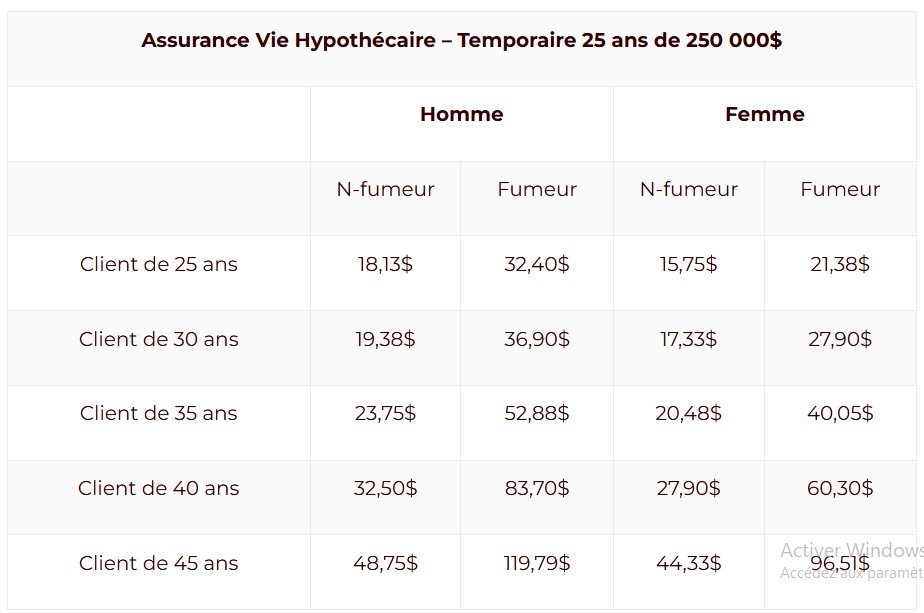

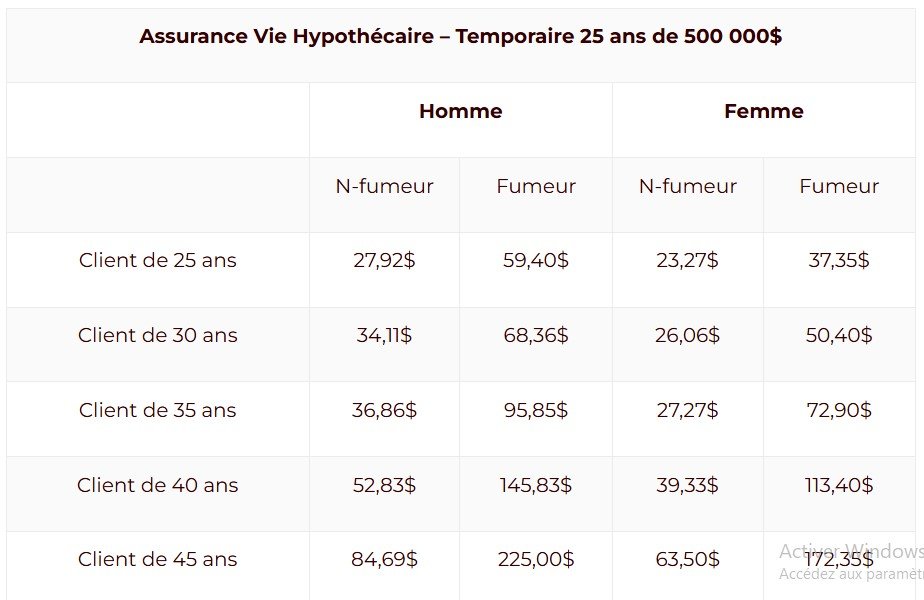

Let's take a look at the average cost of mortgage life insurance in Quebec in 2025. What monthly premium can you expect?

To answer this question, we conducted an analysis based on data collected from several partner insurance brokers.

The rates presented come from an internal study of more than 50,000 submissions received via our platform and our partners between 2017 and 2023.

For all the pricing scenarios discussed, we applied the following standard criteria:

Favorable health status

Classic amortization period of 25 years

Term Mortgage Life Insurance

Customer age between 25 and 45 years old

We then varied the amount of coverage to evaluate the prices for policies of $150,000, $250,000 and $500,000, which correspond to the three most requested levels of protection in Quebec, for both men and women.

Please note that the prices listed are for informational purposes only and are not a guarantee. To obtain personalized quotes, please fill out our free form.

What factors influence the cost of mortgage life insurance?

After examining 60 different rates, let's now look at the specific factors that determine the price of mortgage life insurance in Quebec in 2025.

Insurance companies systematically assess various risks, including the mortality risk associated with each client. This assessment allows them to set an appropriate rate.

But what exactly are the criteria that influence the cost of mortgage life insurance? Here are a few:

Age

Sexe

Le statut de fumeur

Lifestyle habits

Family history

The amount of coverage

The type of insurance chosen

The profession practiced

And many more!

In other words, a young, healthy customer with a healthy lifestyle and a low-risk profession will generally have a more advantageous premium.

Thus, the determination of the premium is based on an actuarial calculation which can vary depending on the company. It is therefore essential to compare the offers of different insurers in Quebec before taking

Can your health affect the cost of your mortgage life insurance?

The answer is yes.

Health is a key factor in calculating your annual life insurance premium. If you have an illness, poor health, or a significant medical history, this can impact:

Your eligibility for insurance

The amount of your bonus

The insurer's decision, some may refuse to cover you if the risks are deemed too high

Conversely, healthy people generally benefit from lower rates. This is why it is recommended to take out mortgage life insurance before health problems arise.

Please note: Some insurance companies specialize in complex medical cases and can offer solutions to clients with health problems.

Life insurance without a medical exam. Is it possible?

Some insurance companies offer life insurance policies without requiring a medical exam. But is this a real alternative for people with health problems? It depends.

The absence of a medical exam does not mean that the insurer automatically accepts all applicants. A health questionnaire is generally required, and if your profile is deemed too risky, the insurer may refuse to cover you.

However, there are no-medical life insurance policies with guaranteed approval. These allow you to obtain coverage even if you have health problems. However, these products are often more expensive than traditional insurance.

Mortgage Insurance: Bank or Insurance Company?

Since the beginning of this article, we've been making a distinction between mortgage insurance and mortgage life insurance. They are, in fact, two very different products.

We have already highlighted the many advantages of mortgage life insurance over traditional mortgage insurance.

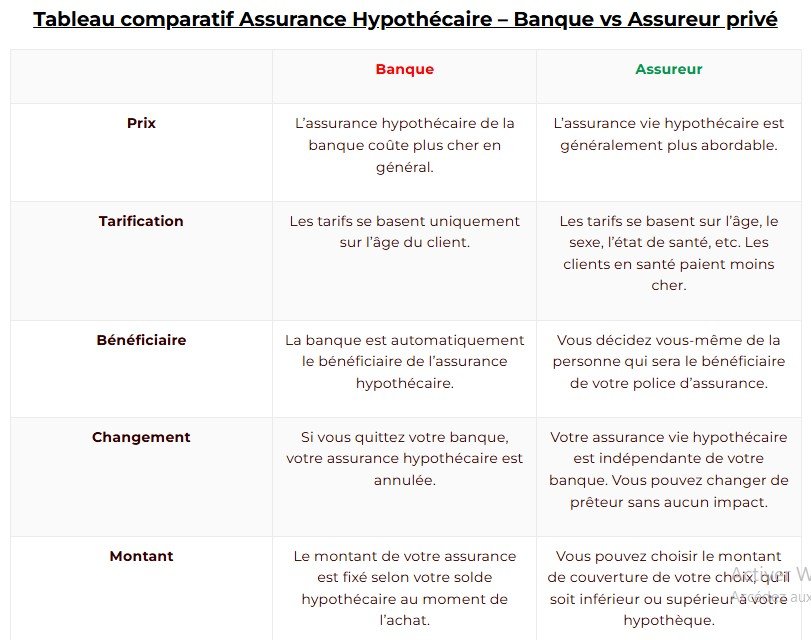

To help you better understand these differences, we have prepared a comparison table that summarizes the main distinctions between these two types of insurance.

This table will help you see why mortgage life insurance is generally a more advantageous option.

Why refuse the mortgage insurance offered by your bank?

If we refer to the comparison table presented above, it is clear that you have two options for protecting your mortgage. However, the insurance offered by the bank is far from being the best.

In fact, it is highly recommended to refuse bank mortgage insurance and opt instead for a mortgage life insurance with a private insurer.

Here's why bank mortgage insurance is not very advantageous, particularly in Quebec:

The beneficiary is always the bank, never your family.

Premiums are often higher than life insurance.

Coverage decreases over the years, along with your mortgage balance.

It is linked to your lender: if you change banks, you lose your protection.

The amount of coverage depends solely on the amount of your mortgage.

Protection automatically ends once the mortgage is repaid.

In summary : Financial experts strongly advise against bank mortgage insurance. In comparison, mortgage life insurance offered by independent insurers is often more flexible, more advantageous and less expensive.

What type of life insurance covers a mortgage?

Mortgage life insurance, as the name suggests, is a form of life insurance designed to pay off a mortgage in the event of death.

In Quebec, there are two main categories of life insurance: insurance temporary and insurance permed. But then, which one is used to protect a mortgage?

Temporary insurance: the ideal solution

Mortgage life insurance is generally based on a term life insurance, because it fits perfectly with the needs of a mortgage loan. Why? Because it is:

Very affordable financially;

Offered for specific durations (10, 20, 30 years, etc.);

Able to provide a great protection to a reduced cost.

Conversely, permanent life insurance is mostly used to cover needs that last a lifetime, such as funeral expenses or estate planning.

So when we talk aboutmortgage life insurance, we generally refer to a temporary insurancetemporary insurance.

Who is paid the amount if you die?

In the event of your death, who will receive the money from your mortgage life insurance? It depends on the person designated as beneficiary at the time of subscription.

When purchasing your insurance, your advisor will ask you to whom you wish to pay the benefit. The beneficiary is often your spouse, especially if he is a co-borrower on the mortgage.

Concrete example:

Let's imagine that 10 years ago you took out mortgage life insurance for 500 000 $, and your spouse is the beneficiary. If you die today, and your mortgage balance is 380 000 $, your insurer will pay 500 000 $ to your spouse. She will then be able to repay the mortgage and keep the remaining $120,000.

Designating multiple beneficiaries – Yes, it’s possible!

With life insurance, you have the freedom to designate multiple beneficiaries. For example, you can assign 75% of the capital to your spouse, 10% to a parent, and 10% to a child. This personalized distribution is completely permissible and common.

Who is paid the amount if you die?

In the event of your death, who will receive the money from your mortgage life insurance? It depends on the person designated as beneficiary at the time of subscription.

When purchasing your insurance, your advisor will ask you to whom you wish to pay the benefit. The beneficiary is often your spouse, especially if he is a co-borrower on the mortgage.

Concrete example:

Let's imagine that 10 years ago you took out mortgage life insurance for 500 000 $, and your spouse is the beneficiary. If you die today, and your mortgage balance is 380 000 $, your insurer will pay 500 000 $ to your spouse. She will then be able to repay the mortgage and keep the remaining $120,000.

What is the difference between mortgage insurance and mortgage loan insurance?

Many customers confuse these two very different terms, even though they are only separated by a single word.

Mortgage insurance is taken out by the majority of homeowners. Its purpose is to protect their loved ones – usually the spouse – in the event of death, by covering the mortgage balance with an insurance payment.

Mortgage loan insurance, on the other hand, is a program offered by CMHC (Canada Mortgage and Housing Corporation). It allows buyers to access property with a down payment of less than 20% – generally between 5% and 19.9%.

In summary, these two insurances meet very different needs: one protects the owner's loved ones, the other facilitates access to property with a low initial contribution.

What is CMHC Mortgage Loan Insurance?

CMHC Mortgage Loan Insurance is a program designed to help buyers access homeownership in Canada with a down payment of less than 20%, which is less than a traditional down payment. In return, the buyer must pay an insurance premium calculated based on the amount borrowed. This premium can be paid immediately or added to the total mortgage amount.

How to get the best mortgage life insurance at the best price in 2025?

Looking for the best way to shop for mortgage life insurance this year? Here's what you need to know.

First of all, avoid automatically subscribing to the insurance offered by your bank. It is not always the most competitive. Instead, opt for the services of a independent life insurance broker holder of a permit issued by theFinancial Markets Authority (AMF).

Why use a broker? Because they can compare offers from several insurance companies for you and help you find the right deal. the best price for coverage tailored to your needs.

With the help of a broker, you can compare the rates of the 20 largest life insurers in Quebec, including:

Canada Life

Empire Life

Sun Life

Desjardins

Industrielle Alliance

Foresters

Humania

…and many others!

It is, without a doubt, The most effective way to save on your mortgage life insurance in 2025.

And if you want to get quotes quickly, we work with partner brokers ready to assist you.

FAQ

Frequently asked questions

C’est une plateforme qui vous met en relation avec des courtiers en assurance pour comparer des offres d’assurance vie.

Vous remplissez un formulaire en ligne, un courtier vous contacte, puis vous comparez les offres pour choisir la meilleure.

Oui, le service est 100 % gratuit pour les clients et sans frais cachés.

Nous aidons à trouver les meilleures assurances vie temporaire, permanente, maladies graves et autres protections via nos courtiers partenaires.

Remplissez simplement le formulaire de demande de devis et un courtier vous contactera rapidement.

Oui, le courtier peut vous proposer différentes options de plusieurs assureurs.