life insurance canada

Term life insurance

Our broker and advisor partners work with the most well-known insurers in Quebec (see list)

What is term life insurance?

Term life insurance is a form of financial protection that covers the risk of death for a pre-defined period of time.

In other words, you choose the duration of your coverage: 5, 10, 20, 30 years or until a specific age, such as 65. Unlike permanent life insurance, which protects you throughout your life, term life insurance ends at the scheduled maturity date.

Its main advantage? It's much more affordable than permanent life insurance. This type of policy is often chosen to meet specific needs, such as:

Provide replacement income to your spouse in the event of death during your working years;

Provide replacement income to your spouse in the event of death during your working years;

Now let's see what the main advantages of term life insurance are.

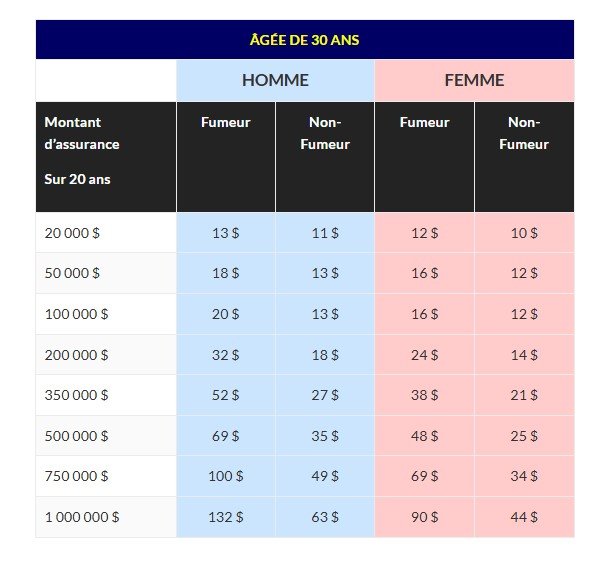

Rate tables for term life insurance based on the insured's age*

For cost transparency, here is an estimate of premiums* for 20-year term life insurance, based on the policyholder's age.

All prices have been rounded up to the nearest whole number. They are based on calculations made using online calculators (as of September 3, 2019) and therefore do not necessarily reflect the rates in effect on that date.

SOLID AND ADAPTED PROTECTION

Do you want to ensure your debts are repaid while you get them under control? Do you want to guarantee financial security for your loved ones or help them improve their financial situation? Term life insurance offers flexible coverage amounts, ranging from $10,000 to $500,000, depending on your budget and needs.

Possibility of conversion to permanent life insurance

To avoid an additional premium at renewal time or to benefit from the advantages of another type of insurance, term life insurance can be converted into permanent life insurance.

ADDITIONAL WARRANTY OPTIONS

Insurers sometimes offer additional health benefits to enhance the coverage of your term life insurance. These options enhance your primary policy and tailor it specifically to your needs.

THE DISADVANTAGES OF TERM LIFE INSURANCE

PREMIUMS INCREASE WITH EACH RENEWAL

At the end of your initial term, your situation is reevaluated and your premiums increase, primarily due to your age. For example (these amounts may not reflect the current market), a 25-year-old man who pays $24 for $100,000 life insurance could see his premiums increase to $31.50 when he renews his 10-year policy at age 35 for the same coverage. For fixed premiums, consider permanent life insurance.

NO SAVINGS COMPONENT AND NO CASH REDEMPTION VALUE

This type of insurance doesn't have a savings component and doesn't generate any cash surrender value; it only offers immediate protection. If you want to use your life insurance as an investment vehicle, this option won't be right for you. Instead, consider universal life insurance, which allows you to invest.

THE MEDICAL EXAMINATION MAY AFFECT YOUR INSURABILITY

Each renewal requires a new insurability assessment, which requires a medical exam (a form that must be completed carefully). If your health deteriorates, your premiums may increase significantly, or your application may even be denied. To avoid this medical exam, consider the benefits of permanent life insurance.

LIMITED TIME COVERAGE

Most insurers don't allow you to renew term life insurance after age 85. Furthermore, if you don't renew your policy—whether through forgetfulness or due to a health issue—your coverage ends permanently, with no residual value.

Why buy term life insurance?

Many people choose term life insurance to enhance their existing financial protection. Here are the main reasons for this choice:

Cover all your debts, including the mortgage.

Protect your business in the event of an unexpected death.

Ensure the financing of your children's studies in the event of your absence.

Pay off your personal debts (student loans, credit cards, etc.).

Maintain your family's standard of living after your death.

Insuring a child's life in the event of a tragic accident.

Preserve the assets you have built over time.

Term life insurance is often offered in different durations, depending on your needs:

1 year term life insurance

5-year term life insurance

10-year term life insurance

25-year term life insurance

100-year term life insurance

How to assess YOUR financial needs before taking out life insurance?

There are many methods available to accurately determine a household's financial needs.

Calling on a financial advisor or an insurance broker remains the best option to carry out this calculation accurately.

That said, the Financial Consumer Agency of Canada offers a practical tool accessible to everyone, allowing you to estimate an approximate amount yourself.

Please note, this tool does not replace professional advice, but it helps you better understand your financial needs.

Simply fill in the fields on the right in this interactive PDF (or print both pages) and follow the instructions to perform the calculations.

Estimating Term Life Insurance Costs: Two Fictitious Examples

Before looking at the examples below, keep these facts in mind:

According to the Institut de la statistique du Québec, in 2017, the average disposable income per capita in Quebec was $28,785.

The median after-tax family income in 2016 was $49,500, according to Statistics Canada.

The average age of the Quebec population was 41.9 years in 2016, according to the Statcan census.

Example #1 :

Based on age-specific rate estimates, assume a household with two parents and two children with an annual income of $49,500.

This household spends about $39.50 per month (or $474 per year) on $350,000 of 20-year term life insurance. This represents less than 0.1% (more precisely, 0.957%) of their annual income.

This insurance protects their $230,000 mortgage, their $20,000 student debt and also provides salary replacement for one parent for nearly four years in the event of their death.

Example #2 :

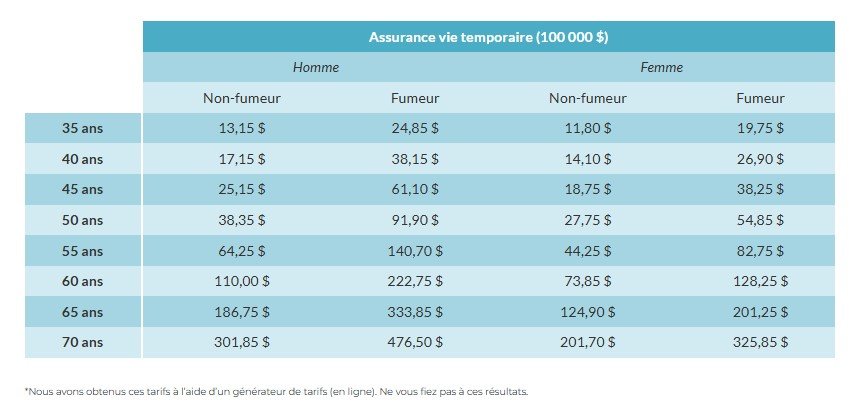

A single, non-smoking, 42-year-old woman, who is middle-aged, takes out $100,000 in term life insurance. Now debt-free, she wants to leave her four nieces some capital to finance their education.

His monthly premium is $16, or $192 per year, which represents only 0.667% of his average disposable income of $28,785.

She plans to divide this capital equally among her nieces, $25,000 each, when choosing beneficiaries.

Examples of term life insurance

The table below shows an estimate of the cost of term life insurance covering $100,000 (these are not official rates, but an average of premiums collected in 2017). To find a broker who can compare offers from more than 20 insurers, fill out the form available on this page.

Compare more than 20 insurers for your term life insurance thanks to a partner broker

En by filling out the form on this page, you access a network of insurance brokers. This tool allows you to compare offers from more than 20 insurance companies through this network, in order to receive the best quote suited to your needs.

In an increasingly international market, take advantage of this ease of communication to shop comfortably from home. It only takes two minutes to complete the form, and one of our partners will contact you shortly by phone or email with a personalized proposal based on your criteria.

FAQ

Frequently asked questions

C’est une plateforme qui vous met en relation avec des courtiers en assurance pour comparer des offres d’assurance vie.

Vous remplissez un formulaire en ligne, un courtier vous contacte, puis vous comparez les offres pour choisir la meilleure.

Oui, le service est 100 % gratuit pour les clients et sans frais cachés.

Nous aidons à trouver les meilleures assurances vie temporaire, permanente, maladies graves et autres protections via nos courtiers partenaires.

Remplissez simplement le formulaire de demande de devis et un courtier vous contactera rapidement.

Oui, le courtier peut vous proposer différentes options de plusieurs assureurs.