life insurance canada

Do you think you are uninsurable?

Are you having difficulty obtaining life insurance due to your age or health? Have you ever been refused?

Our broker and advisor partners work with the most well-known insurers in Quebec (see list)

How much does life insurance cost without a medical exam?

What is life insurance without a medical exam?

Also called guaranteed membership life insurance, this formula allows you to take out life insurance without filling out a long medical questionnaireAcceptance is automatic, and protection begins as soon as the insurer receives the request.

This type of insurance is primarily aimed at people who face obstacles in obtaining traditional life insurance. Thanks to its quick installation and to his effective immediately, it attracts a growing number of customers, particularly in a context of an aging population.

A 2017 study by Life Happens and LIMRA highlights a striking fact: Only 30% of respondents were comfortable sharing their medical information with insurance companies, while 70% said they would take out life insurance if the medical examination was abolished.

The detailed medical forms required by traditional insurers expose individuals' vulnerabilities, often leading to a significant increase in premiums.

Today, consumers are better informed. They compare offers online, research tailor-made solutions and appreciate simplified procedures. Faced with these changing expectations, the insurance sector is adapting its products to better meet the specific needs of certain customer segments.

The advantages of life insurance without a medical exam in Quebec

No medical exam life insurance represents a valuable solution for those who have long been excluded by a system that often favors young and healthy people.

Here are the main advantages of guaranteed membership life insurance:

Clearly defined benefits

Immediate coverage upon subscription

Fixed premiums guaranteed for life

Available up to the age of 70 from most insurers

Fast, often instantaneous emission

Simple subscription procedures

Easily available online

Want to know if this option is right for you? Fill out the form on this page. One of our partners—experienced insurance brokers—will contact you shortly with a proposal tailored to your situation.

Traditional life insurance vs. life insurance without a medical exam: what are the differences?

In Quebec, most insurance companies generally require a medical examination to purchase life insurance.

However, when a person is in good health and has no particular family history, the insurer may waive this requirement.

No medical exam life insurance is designed for individuals whose health is more fragile or uncertain, and who still want to obtain coverage, without having to undergo medical tests.

Although its cost is generally a little higher than that of traditional life insurance, it represents an interesting solution for those who have difficulty obtaining insurance otherwise.

Who is no medical exam life insurance for and what are the rates?

Guaranteed membership insurance — also called life insurance 50+ at Desjardins — is gaining visibility, particularly through radio and television advertisements, and through inserts placed in urban neighborhoods. It highlights the simplicity and accessibility of coverage without medical exams.

This type of insurance is mainly aimed at those who:

Regularly attend health establishments,

Take medication on an ongoing basis,

Have health conditions that would make it difficult to qualify for traditional insurance.

Insurers set premiums based on in-depth statistical analyses, based on various risk factors, including:

The age of the insured,

Tobacco consumption,

The presence or absence of known health problems.

💡 To note : If you're under 50 and in excellent health, it might be a good idea to explore other life insurance options, such as a term or permanent policy. These types of policies can offer you better coverage at a much lower rate, while sometimes serving as leverage for financial investments.

Why choose insurance without a medical exam?

If your goal is simply to set aside an amount to cover your funeral expenses, without undergoing the usual medical examinations, this type of insurance is for you. The subscription process is extremely simple: only three pieces of information are taken into account to determine the cost of your premium:

Your age,

Your sexe,

And if you are you a smoker or not.

How do prices vary?

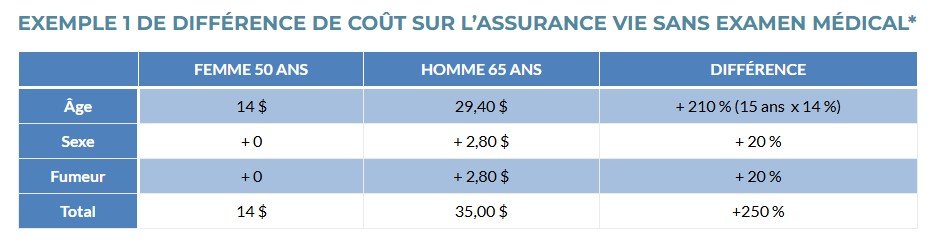

Here are the main price differences observed:

A woman will pay about 20% less than a man (men being considered at greater risk).

A non-smoker will also pay about 20% less than a smoker.

From the age of 50, each additional year results in an increase of about 14%.

Concrete example: Between a 50-year-old non-smoking woman and a 65-year-old smoking man, premiums can show a very significant price difference.

To note: The amounts mentioned below are provided for example purposes only and should not be considered definitive values. Do not rely on the rates indicated in this example.

So, if a 50-year-old woman had to pay $14 per month for her insurance premium, a 65-year-old man would instead pay $35 for the same coverage.

This scenario clearly illustrates the importance of purchasing no-medical life insurance as early as possible. Once the policy is signed, the premiums remain fixed for life. In this case, if this man had purchased the policy 15 years earlier, he would have saved approximately $16 per month. Therefore, it's wise to compare life insurance offers from different insurers to save substantial amounts.

Medical examinations in life insurance: what are we talking about?

In this section, we are referring to so-called "traditional" life insurance policies, not to guaranteed or immediate enrollment policies.

Don't worry! It's perfectly normal for your insurer to ask you a few questions about your health. This is because companies invest in healthcare professionals to analyze your medical profile. Nurses or doctors may even visit your home to perform blood tests, urine tests, or any other examinations deemed necessary.

Contrary to popular belief, you do not need to travel to take these tests.

These analyses allow the insurer to accurately assess the level of risk you represent, with the aim of offering you a suitable policy. By incurring these costs, the company shows that it genuinely wants you to be one of its policyholders. Their goal is not to reject you, quite the opposite.

Consider requesting a copy of your test results to share with your doctor. This is an excellent opportunity to update your medical records.

Guaranteed Membership Life Insurance: Is It a Good Option for Me?

In recent years, new types of life insurance products have appeared on the market. These are known as "no medical exam life insurance," "guaranteed enrollment insurance," or "50+ insurance." These offers, offered by institutions such as Desjardins, Manulife Financial, and National Bank, allow you to bypass the medical exam.

Many people choose these products for the simplicity and speed of subscription. However, two important elements are often overlooked:

Some companies do not activate coverage immediately. A 24-month waiting period may be required before coverage takes full effect.

Depending on your health, traditional insurance may be more economical.

How to avoid the waiting time?

By comparing offers on the market, you can find insurers that offer immediate coverage, even without a medical examination.

Who is no medical exam life insurance really suitable for?

This type of insurance is mainly aimed at those who:

Have health problems that make it difficult to access traditional insurance.

Want a quick and hassle-free subscription.

Are past a certain age and looking for a simplified solution.

However, before making your choice, always take the time to compare the different options available, taking into account your profile, your needs and your budget.

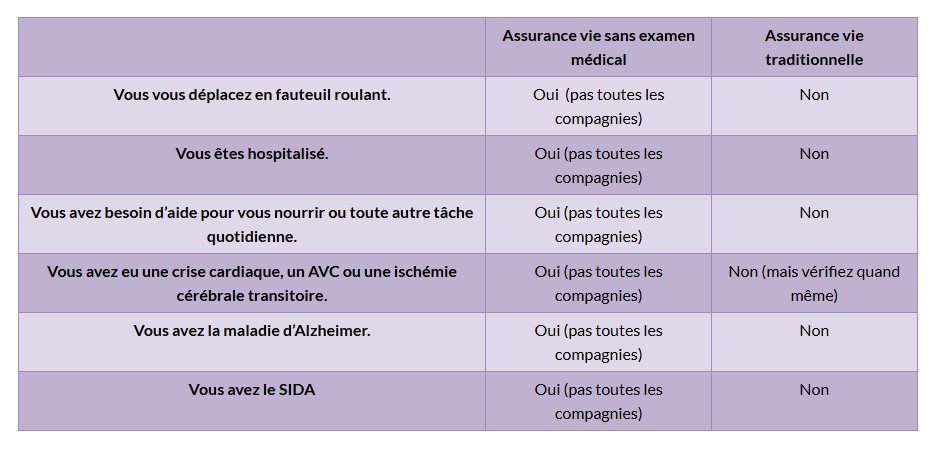

You may be wondering how someone can be rejected for life insurance without a medical exam, when no medical records appear to be required. In reality, "without a medical exam" doesn't mean the insurer won't ask any questions. Each company applies its own selection criteria and may filter out applicants deemed at risk based on a health questionnaire.

For example, at Desjardins, 50+ insurance includes a series of questions to assess whether the applicant's profile represents too great a risk. Here's what they're looking for:

Have you ever been, or are you currently:

Refused by a life insurance company or accepted with an additional premium?

Confined to a bed or a wheelchair?

Living in a long-term care or convalescent facility?

Unable to feed yourself or provide for your personal needs?

Diagnosed or treated for a heart attack, stroke, diabetic coma, angina, cancer, or TIA (transient ischemic attack)?

Waiting for results or treatment for any of the conditions mentioned above?

Follow-up for cancer treated less than 5 years ago?

Suffering from Alzheimer's disease?

Diagnosed with emphysema, HIV (AIDS), kidney failure or liver cirrhosis?

If you answer “yes” to any of these questions, your application may be denied.

Each company assesses risks differently. What one insurer considers too risky may be considered acceptable by another. Therefore, a rejection today doesn't mean you'll always be uninsurable. The criteria change every year, and a company that rejected you this year may accept you next year.

That's why it's essential to explore all available options. Contact one of our broker partners: they will analyze your situation in detail and guide you toward the best solution. Simply fill out the form on this page to receive your free personalized proposal.

FIND THE NO MEDICAL EXAM LIFE INSURANCE POLICY THAT’S RIGHT FOR YOU!

Fill out this form to receive personalized support from one of our partner brokers, all insurance experts. You'll quickly receive a quote tailored to your needs.

Is 50+ life insurance the same as no medical exam life insurance?

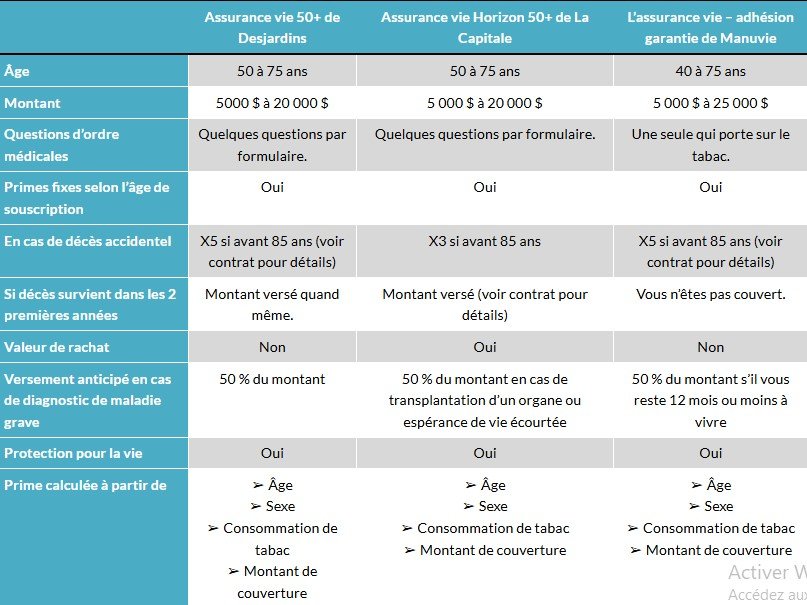

50+ life insurance is a term used by some insurance companies to specifically target people of a certain age. This type of product generally offers the same benefits and very similar eligibility criteria as no-medical life insurance. For example, Manulife offers this product under the name “Guaranteed Life Insurance,” National Bank calls it “50+ Life Insurance,” and La Capitale calls it “Horizon 50+.” Here’s an overview of these three offerings:

We see that the offers have many similarities. However, slight variations in premium prices, depending on certain criteria, can favor some companies over others. Depending on your health status, the most advantageous solution will also be the most economical.

With no-medical life insurance, you shouldn't expect to receive the full benefit in the event of imminent death. You may receive only half of the coverage if all conditions are met. Some companies impose a 24-month waiting period after signing the policy before coverage becomes fully effective. In this case, the benefit paid will only correspond to the premiums paid during this period.

Insurers seek to protect themselves as much as possible, as they do not always have accurate information about their clients' health. By collecting two years of premiums, they give themselves sufficient time in the event of a serious diagnosis.

Although more expensive than other types of life insurance, no medical exam life insurance still offers protection in the event of misfortune. By opting for a higher amount, you can anticipate debt repayment, cover funeral expenses, and even leave an inheritance to your loved ones. It's important to carefully consider the benefits of this insurance, as it may be the only option for someone in fragile health.

However, if you're still unsure after reading this, you can try a term life insurance quote. The medical questionnaire is more detailed, but no medical exam is required. You have nothing to lose. Passing a medical exam today is easy, and if you fail, you can always opt for no-medical life insurance (guaranteed enrollment).

So, how much does this no medical exam life insurance cost?

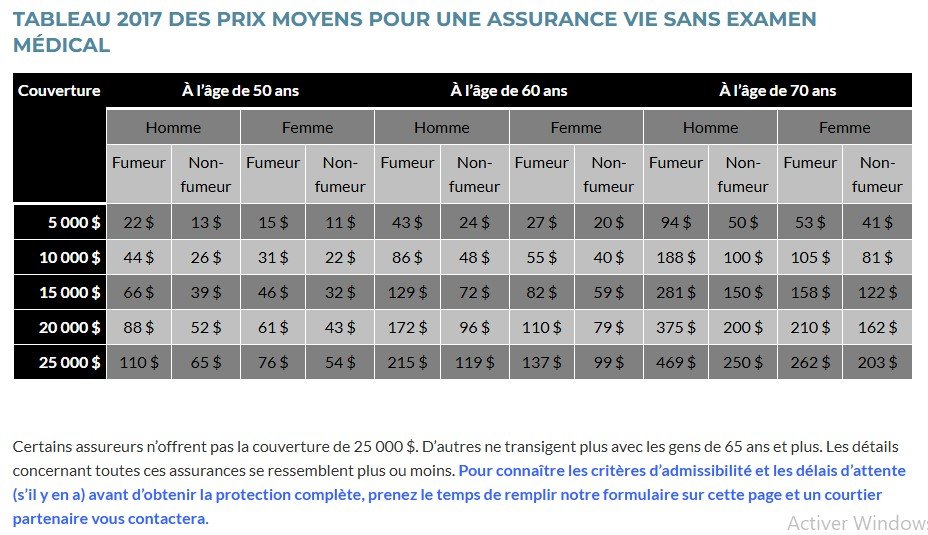

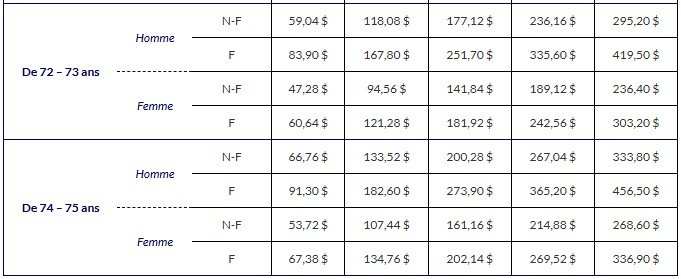

Please note that rates vary greatly between companies. We compiled data from more than four insurers to obtain an indicative average, with rounded results. These 2017 rates will change next year.

The table below gives you a realistic estimate of possible coverage amounts, as well as the corresponding premiums, depending on your age, gender and smoking status.

Attention! Check out these important additions that complement this article on guaranteed enrollment life insurance.

2019 Update

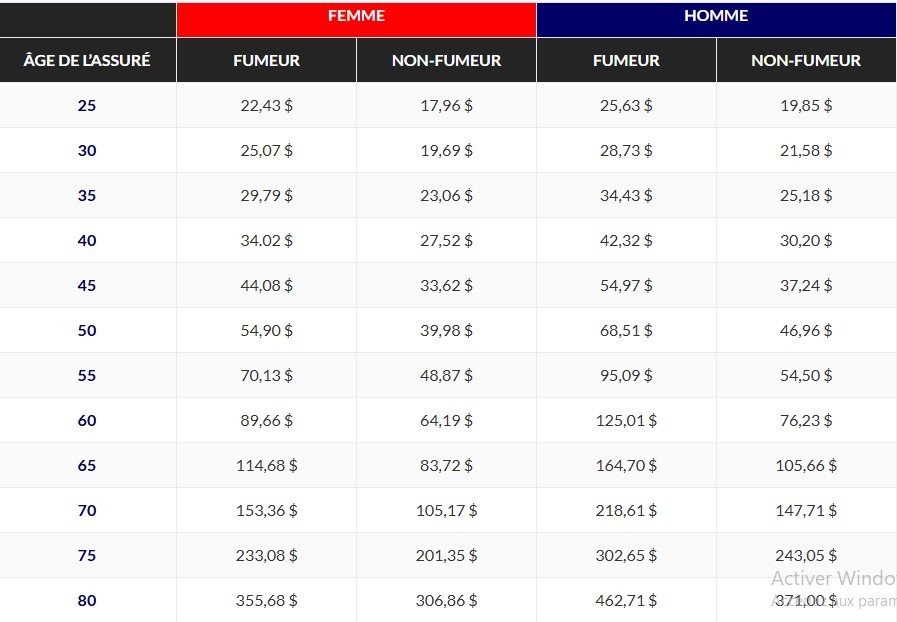

Price* of simplified subscription life insurance for people aged 25 to 80

In July 2018, new data now gives you better visibility on the cost of premiums for this currently very popular product.

The table below therefore presents a more representative estimate of prices for a person aged 40 to 75.

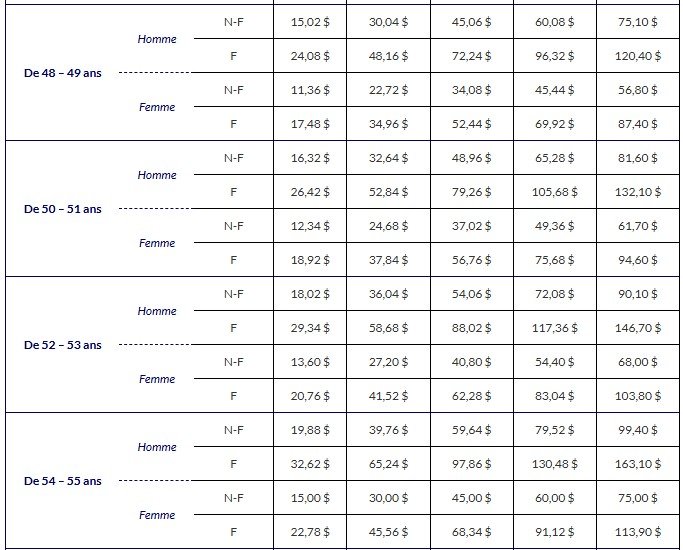

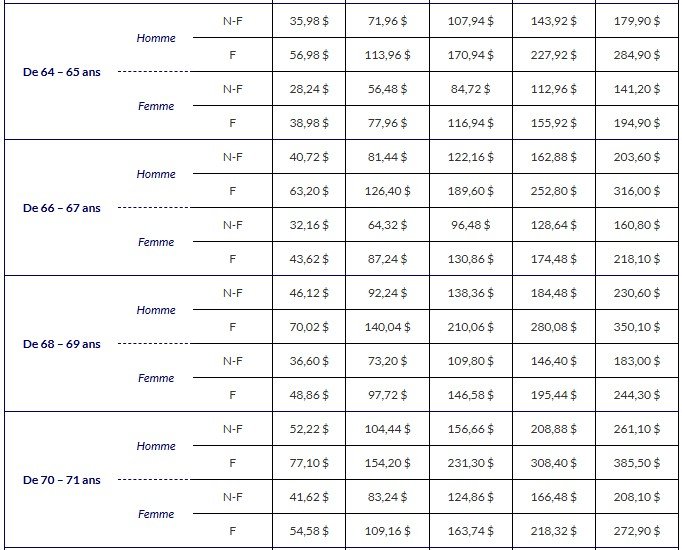

Update 2018

Life insurance rates without medical examination

The most effective way to find the most interesting offer on the Quebec market is to call on an expert in the sector.

Our partners are insurance brokers and financial security advisors, located throughout the province.

Fill out the short form at the top of the page so that one of our partners in your region can study your situation.

Very soon, you will receive a FREE quote, with no obligation on your part!

FAQ

Frequently asked questions

C’est une plateforme qui vous met en relation avec des courtiers en assurance pour comparer des offres d’assurance vie.

Vous remplissez un formulaire en ligne, un courtier vous contacte, puis vous comparez les offres pour choisir la meilleure.

Oui, le service est 100 % gratuit pour les clients et sans frais cachés.

Nous aidons à trouver les meilleures assurances vie temporaire, permanente, maladies graves et autres protections via nos courtiers partenaires.

Remplissez simplement le formulaire de demande de devis et un courtier vous contactera rapidement.

Oui, le courtier peut vous proposer différentes options de plusieurs assureurs.