life insurance canada

Permanent life insurance

Our broker and advisor partners work with the most well-known insurers in Quebec (see list)

Quels sont les avantages de l’assurance vie permanente au Québec ?

What is permanent life insurance?

In Quebec, life insurance protections are generally divided into two main categories: insurance temporary and the insurance permanent.

Permanent life insurance, as the name suggests, guarantees you protection for life. Unlike temporary insurance, it has no expiration date : as long as you comply with the terms of the contract, the coverage is in effect until your death.

You can choose to pay lifetime premiums, or opt for a time-limited payment (accelerated payment), while maintaining lifetime coverage.

The amount of coverage is determined when the contract is signed. For example, if you choose protection of 100 000 $, this amount will be paid to your designated beneficiary at the time of your death.

Permanent life insurance is often used for:

Cover the funeral costs

Leave a legacy to your loved ones

Payer l’latent tax on certain assets transferred to your heirs

In short, this form of insurance constitutes a solution durable and secure, highly prized by many Quebec families to ensure their peace of mind.

CAN YOU SAVE BY REPLACING YOUR TERM LIFE INSURANCE?

When it comes to choosing life insurance in Quebec, it's surprising to see how many couples, in their prime, are hesitant to opt for term life insurance.

Yet, this plan is very affordable and provides high levels of coverage at a low cost. Better still, it can be tailored to family needs by combining protections for certain debts, loans, and even your mortgage—often resulting in substantial savings.

Let's take the example of a couple to compare the costs over a 30-year period between term life insurance and permanent life insurance:

Profile : Non-smoking woman, in excellent health, 35 years old. Non-smoking man, also in excellent health, 35 years old.

Desired coverage amount: $100,000 for the couple.

Here are the monthly premiums:

Permanent life insurance: 87 $/month (or 1 044 $/an).

Permanent life insurance: 25 $/month (or 300 $/an).

The difference is obvious: term life insurance offers significant savings. However, few people realize that after 10 years, the policy must be renewed. At that point, your health will need to be reassessed, and your premiums will automatically increase, simply because you're 45. Even if you're still healthy, the costs could nearly double.

This is where permanent life insurance comes into its own, offering long-term stability that can be beneficial depending on your situation.

In the rest of this article, you will discover the advantages and limitations of these two types of life insurance, as well as practical tips for saving through portability.

And if you're already well-informed and want to take action, click the link below to get a free quote from one of our partner brokers!

FIND THE TERM OR PERMANENT LIFE INSURANCE POLICY THAT’S RIGHT FOR YOU!

Fill out this form to receive personalized support from one of our partner brokers, all insurance experts. You'll quickly receive a quote tailored to your needs.

Which option is best for you: permanent life insurance or term life insurance?

The wide range of life insurance products available can easily be confusing, especially for those new to the field. Should you choose term life insurance or permanent life insurance? Which solution is best suited to your situation?

Good news: here you will find a complete overview of the different options available on the market, to help you make an informed choice according to your needs.

Life is full of unexpected events, from happy moments to challenging ones. It's therefore essential to take the time to examine the various protections available to ensure your peace of mind. Here are the solutions available to you, clearly explained.

What is term life insurance?

This is the most economical option for life insurance, often recommended as a starting point. The amount of your premium depends primarily on the length of your coverage (1, 5, 10, 25, 50, or even 100 years!) as well as personal criteria such as your age, gender, and whether you are a smoker or non-smoker.

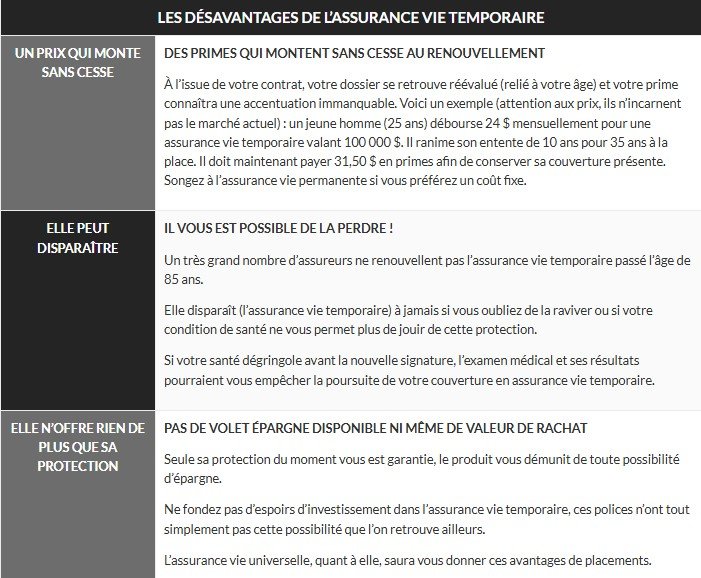

However, don't let its low price fool you! Each renewal requires a new health assessment. As you age or if medical problems arise, your premiums are likely to increase. Therefore, in the long run, permanent life insurance can be more stable and cost-effective.

That said, term life insurance often addresses short-term needs. It's ideal for covering yourself during a riskier period in your life or protecting your loved ones from temporary debt.

Les différentes durées offertes en assurance vie temporaire :

1 years

3 years

5 years

10 years

25 years

25 years

35 years

50 years

100 years

If you'd like a quick quote for either term or permanent life insurance, simply follow the link on this page. A partner broker will contact you shortly.

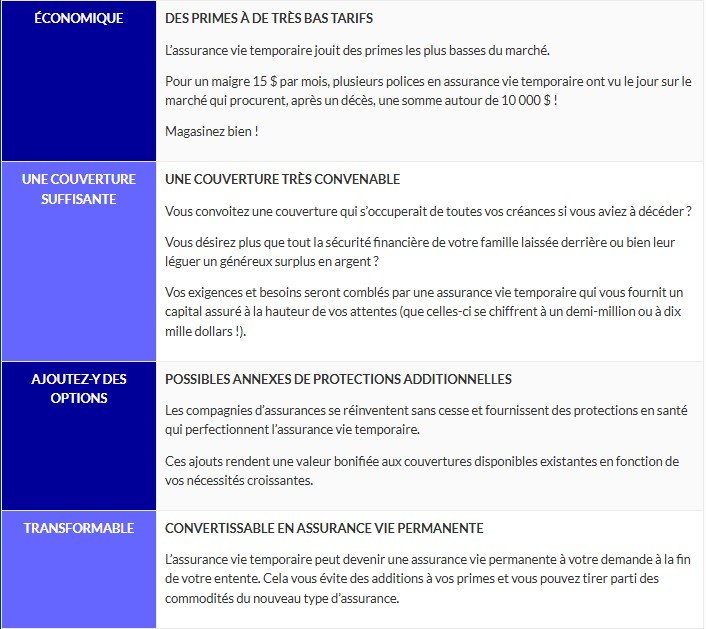

HERE ARE THE BENEFITS OF TERM LIFE INSURANCE

If, after reading everything, you are ready to take out life insurance and work with one of our partners (life insurance brokers), all you have to do is fill out the form available on this page.

It’s 100% free… and you won’t regret it!

Who should buy term life insurance?

Term life insurance is often chosen to supplement existing coverage. There are several reasons for this choice, including:

Ensure the maintenance of the standard of living of your loved ones after your death.

Set aside a fund for your children's education in case of premature absence.

Guarantee the repayment of your debts, including your mortgage.

Protect the assets you have acquired over the years.

Cover your personal debts (credit cards, student loans, etc.).

Leave a blanket for your children to protect them from an unexpected tragedy.

Provide financial protection for your business in the event of a serious accident.

Many experts, including financial planners, recommend term life insurance for periods of 10 to 20 years. They appreciate its affordability, its fixed term, and the ability to adjust coverage over time. Your insurance needs evolve: once the mortgage is paid off, your investment accounts (such as your TFSA and RRSP) are fully funded, and your children become independent, your financial obligations decrease.

Also consider converting your term life insurance to permanent life insurance without having to retake a medical exam. This allows you to avoid the hassle of renewal while maintaining long-term protection tailored to your situation.

Second, let's talk about permanent life insurance

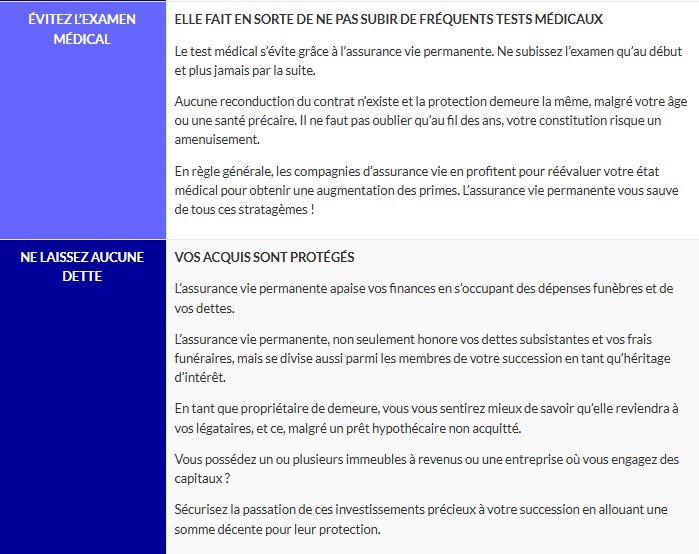

Permanent life insurance provides lifetime coverage, ensuring lasting financial protection for your loved ones, even after you're gone. It's an essential part of your estate and provides peace of mind for those around you.

This form of insurance is a real shield: once purchased, it stays with you until the end of your life (some policies, however, set a maximum age for payments). Premiums remain constant throughout the contract, although they are generally higher at the beginning compared to those of term life insurance.

Permanent life insurance also stands out for its flexibility. It can be enhanced with additional guarantees, specific clauses, and personalized options, making it even more advantageous.

What is the difference between permanent life insurance and universal life insurance?

Permanent life insurance comes in two main types: whole life insurance and universal life insurance.

If you want to add an investment dimension to your policy, universal life insurance is the best option. It allows you to build an investment portfolio with fixed or variable premiums, depending on the type of policy.

Would you like to know more?

Do not hesitate to contact one of our partner brokers specializing in life insurance.

Understanding Cash Surrender Value in Permanent Life Insurance

What is “cash surrender value” in permanent life insurance?

This is the amount you can recover if you decide to terminate your permanent life insurance policy. In other words, this value represents a cash return you can collect after paying premiums for several years.

Once you've been contributing for a while, an amount—often significant and sometimes in the thousands of dollars—accumulates and appears on your annual statement. This is called the cash surrender value.

How can this cash surrender value help you?

Cash surrender value can be a real lifeline in the event of financial difficulties. In exchange for canceling your policy, the insurance company will return this amount to you (subject to tax), which also allows them to avoid having to honor the entire initial coverage. This is why it is essential to think carefully before canceling your permanent life insurance.

You will receive a lump sum, but this also means that all your protections will disappear permanently.

When should you consider buying back your permanent life insurance?

Here are some situations where a buyout may be a possible solution:

In case of urgent financial problem : for example, if you need cash quickly and have been refused a personal loan.

When you have other sufficient insurance : If another coverage already meets your financial needs, you may consider dropping the first one.

If insurance is no longer necessary : when your savings or investments have become sufficient to compensate for the loss of this protection.

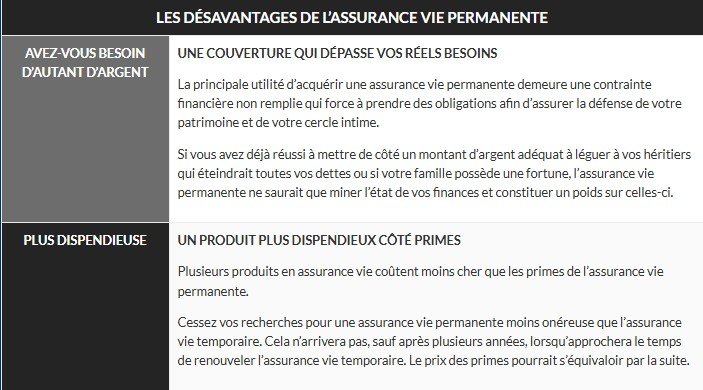

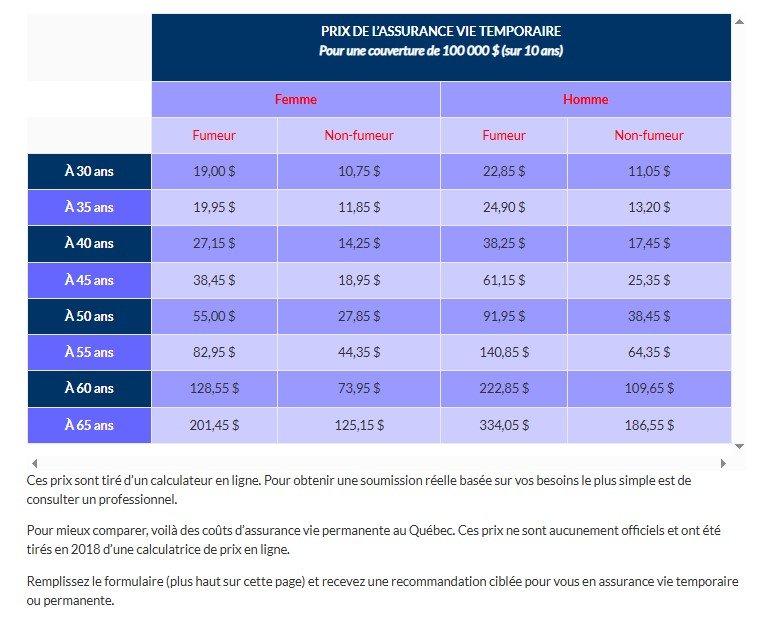

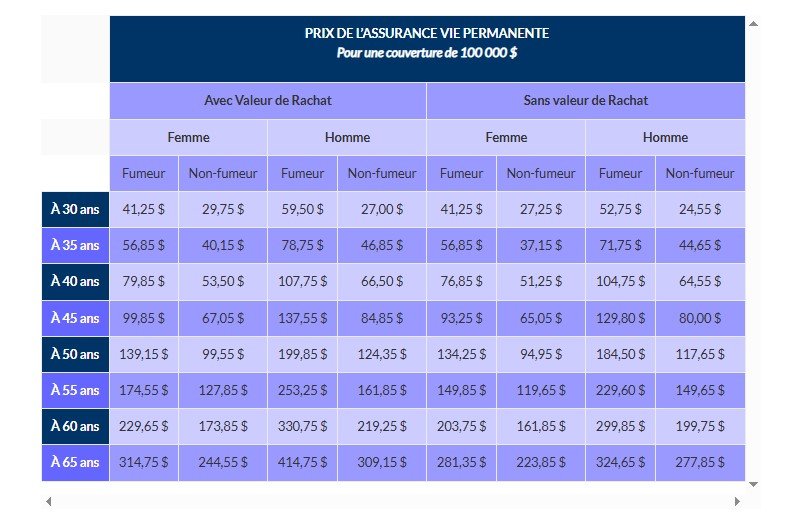

Discover the rates for term and permanent life insurance

To get an idea of the prices of term life insurance premiums in Quebec, here is a comparative table with some examples (note that this data is indicative and was generated in 2018 using an online tool; it does not constitute official figures).

Compare offers from more than 20 life insurance companies now and fill out the form on this page to receive a personalized quote from a partner broker!

How to evaluate the cost of permanent or term life insurance?

Example 1 :

Let's say you buy term life insurance at age 35 and you're a healthy male smoker. Your monthly premiums are $24.90 for a 10-year term.

At age 45, your premiums increase to at least $61.15, and a new medical exam is required. Still in good health, you decide to keep your term life insurance.

At age 55, your premiums jump to $140.85 upon renewal.

As you approach 65, you realize that converting to permanent life insurance would be advantageous, particularly to avoid medical exams.

In total, you will have paid $27,228 in premiums over 30 years.

If you had chosen permanent life insurance with cash value from the start, the monthly cost would have been $78.75, or $28,350 over 30 years.

In this case, your good health has saved you about $1,000 over 30 years, making term insurance a good choice.

Example 2 :

Let's imagine a non-smoking, healthy woman who buys term life insurance at age 30. For $100,000 of coverage, she pays $10.75 per month.

She keeps this insurance for 40 years, until age 70, and remains in good health. In total, she will have paid $15,216.

However, a serious illness occurs, ending his insurance at the next renewal.

If she had chosen permanent life insurance, she would have paid $14,280 over the same period, with fixed premiums for life.

Here, permanent life insurance is the best option, as it allows you to save after age 70 and also offers a cash surrender value, a real asset.

Example 3 :

You are a 45-year-old non-smoker who chooses term life insurance, while your twin brother chooses permanent life insurance.

Your monthly premiums are $25.45 and $84.85 respectively.

Seven years later, you develop cancer, as does your brother. After two years of treatment, you are both cured.

On the renewal date, your insurer refuses to extend your contract, while your brother keeps his without any problem.

You find yourself without protection, which compromises your financial future and that of your family.

Your brother, on the other hand, has better security.

FAQ

Frequently asked questions

C’est une plateforme qui vous met en relation avec des courtiers en assurance pour comparer des offres d’assurance vie.

Vous remplissez un formulaire en ligne, un courtier vous contacte, puis vous comparez les offres pour choisir la meilleure.

Oui, le service est 100 % gratuit pour les clients et sans frais cachés.

Nous aidons à trouver les meilleures assurances vie temporaire, permanente, maladies graves et autres protections via nos courtiers partenaires.

Remplissez simplement le formulaire de demande de devis et un courtier vous contactera rapidement.

Oui, le courtier peut vous proposer différentes options de plusieurs assureurs.