life insurance canada

Critical illness insurance

Our broker and advisor partners work with the most well-known insurers in Quebec (see list)

Get critical illness insurance without a medical exam in 2025 – acceptance guaranteed!

No one is immune to health problems, and illness can occur at any time, regardless of age or physical condition.

In Canada, the Canadian Cancer Society estimates that 2 in 5 people will be diagnosed with cancer during their lifetime. In addition, according to the Heart and Stroke Foundation, a person has a stroke every 7 minutes.

Despite these worrying data, survival rates continue to improve, which makes it more essential than ever to benefit from a good critical illness insurance to cope with the unexpected.

On this page you will find all the necessary information on this type of insurance. And by filling out our form, you can obtain a critical illness insurance without medical exam – with guaranteed approval.

Have you ever been refused critical illness insurance in Quebec?

It's not uncommon for some insurers to require comprehensive medical examinations before allowing people to purchase critical illness insurance. As a result, many people are denied coverage, whether due to family history or test results.

If this has happened to you, you've come to the right place.

Because contrary to what one might believe, Not all insurers in Quebec require medical tests to provide critical illness insurance. Some offer guaranteed approval, regardless of health status.

How is this possible? Which insurers offer this type of coverage? What are the advantages of choosing this solution?

We explain everything in detail below.

Get critical illness insurance without a medical exam – with guaranteed approval!

Thanks to our platform, it is now possible to access critical illness insurance without undergoing a medical examination. Better yet: your approval is 100% guaranteed !

Whether you've already been denied or are looking for reliable and affordable coverage, you are in the right place to find a solution adapted to your needs.

You just need to fill in our free, no-obligation formWe will quickly put you in touch with one of our specialist partners, who will take the time to analyse your situation and offer you the most relevant options.

- 100% free form

- No medical exam required

- No-obligation meeting with an expert

So what are you waiting for?

Book an appointment now or read on to discover all the benefits of this insurance available to everyone.

What is critical illness insurance?

If you're not sure what critical illness insurance is, it's probably one of the most essential protections you can consider in your lifetime.

But how does it work, in practice?

Critical illness insurance can be defined as financial coverage that pays you a lump sum if you are diagnosed with a critical illness covered by your policy—such as cancer, a stroke, or a heart attack. This sum can be used freely to cover your medical expenses, compensate for lost income, or meet any other financial needs during your recovery.

Critical illness insurance provides a tax-free lump sum payment if you are diagnosed with an illness covered by your policy and survive beyond the waiting period, generally set at 30 days.

In short, critical illness insurance is a protection for which you pay monthly premiums. It kicks in if you are diagnosed with a critical illness covered by your policy. To be eligible for the lump sum payment provided by your insurance—a tax-free amount—you must first survive the waiting period stipulated in your policy, usually 30 days.

This time limit means that from the moment a diagnosis is made, you must survive a certain number of days before compensation is paid.

Let's take a concrete example: you consult a doctor and are diagnosed with lung cancer, a disease included in your policy. It provides a capital sum of $75,000 and a 30-day waiting period. If you survive this period, you will receive the entire amount, tax-free.

It’s that simple. The amount paid can then be used as needed to:

Cover medical treatments and medications;

Compensate for loss of income due to work stoppage;

Support your spouse who may have to take unpaid leave;

Repay part or all of your mortgage;

And much more.

What are the benefits of critical illness insurance?

Critical illness insurance offers many benefits, both financially and psychologically. It represents a real lifeline for many people facing difficult diagnoses. Here are some reasons why more and more people are choosing this type of protection with confidence:

Priceless peace of mind : In the event of a serious illness, you can fully concentrate on your recovery, without having to worry about your finances.

Compensation for loss of income : If you are unable to work, insurance can replace your income temporarily.

Protecting your savings : You don't need to dip into your savings to cover your medical or living expenses.

Payment of a tax-free capital sum : The amount received is not subject to tax, which allows you to take full advantage of it.

Reimbursement of premiums possible : Some contracts include a premium refund clause if the insurance is never used.

Paying off your mortgage : The capital can be used to pay off your mortgage, thus reducing your monthly costs.

Bankruptcy Prevention : In case of high medical expenses or prolonged loss of income, insurance protects you against extreme debt.

Moral support for you and your loved ones : You and your spouse will benefit from valuable peace of mind during this trying time.

Evolution towards other protections : Some products allow you to convert your insurance into long-term care coverage.

And much more!

In short, critical illness insurance offers robust protection against the financial consequences of a major health issue. It provides you with financial support to cover daily expenses and maintain your quality of life, without having to sacrifice your assets or incur debt.

It’s much more than just insurance: it’s a human gesture, focused on your well-being and that of your loved ones.

A client deemed uninsurable finally finds insurance thanks to our partners

Some stories give us hope and show that we should never give up, even when everything seems impossible.

One of our partners told us about his encounter with a client who, suffering from multiple sclerosis, was systematically refused "critical illness" insurance. Discouraged, he was convinced that no company would accept him. However, by simply filling out our form, he was able to connect with a specialized advisor who was able to find the coverage suited to his case.

How can we explain this success? Simply because not all advisors necessarily have the expertise or access to the tailor-made products needed to support atypical profiles. Our partners, on the other hand, are trained to resolve a wide variety of complex situations and offer solutions where others fail.

If you too feel like you're at a dead end and no insurer wants to cover you for critical illness insurance, take a break and fill out our form. We'll put you in touch with a specialist who will review your file and find the best option for you!

Why do financial planners recommend critical illness insurance?

In the past, a diagnosis of a serious illness often meant a low chance of survival. Today, medical science has made tremendous progress, and survival rates are significantly higher. However, without insurance, illness can lead to time off work, loss of income, and the need to dip into savings to fund treatment and rehabilitation. Upon recovery, many find they've depleted their savings, returning to their original goal.

To prevent this scenario, financial planners strongly recommend critical illness insurance. In the event of a diagnosis, it pays benefits to compensate for lost income, thus avoiding having to touch your investments or personal savings. Rather than an expense, consider this insurance as a protective investment for your future!

Currently, benefits paid under critical illness insurance are not taxable!

If, unfortunately, you were to be unable to work due to a serious illness, your insurance would then pay you benefits.

But did you know that these amounts are not subject to tax?

In fact, when the critical illness insurance contract meets the legal definition of health insurance, the Canada Revenue Agency considers them as non-taxable benefits, in accordance with the Income Tax Act.

In other words, as long as the legal criteria are met, critical illness insurance benefits are paid to you tax-free.

Note, however, that depending on the terms of the contract, a period of survival from the illness is generally required before payments begin.

These benefits can really make a big difference in helping you cover your bills, compensate for lost income, and fund your care and treatment.

The key thing to remember: the amounts received following a diagnosis under this insurance will not be taxable and will not be considered income.

To find out exactly how much you are entitled to, do not hesitate to consult your advisor.

This way, you can fully focus on your recovery and your health – that’s what really matters!

Critical illness insurance with premium refund clause

Purchasing critical illness insurance is arguably one of the best decisions (and investments) you can make. However, it's entirely possible that you'll never experience a critical illness in your lifetime.

This is why some insurers now offer contracts including a premium reimbursement clause.

What does this mean exactly? It's simple and beneficial.

This clause allows you to recover part or all of the premiums you have paid, either if you cancel your contract or when it expires.

In other words, if you never use your insurance, the insurer agrees to reimburse you for part or all of the sums you have paid.

Of course, this type of contract is generally more expensive than traditional critical illness insurance, but it represents an attractive option for many.

In addition, the Canada Revenue Agency considers these refunds not to be taxable income, as long as their amount does not exceed the total premiums paid, which means that you will not pay tax on this refund.

Interesting, isn't it?

Please note, however, that if you use your insurance for a serious illness, this clause becomes void.

In short, this product offers you slightly more expensive protection when you use it, but is much more economical if you never need it.

It's up to you to decide if this option suits your needs!

Critical illness insurance with option to convert to long-term care insurance

There are critical illness insurance policies that offer a unique option: being able to convert them into long-term care insurance, without having to provide new evidence of insurability.

This type of product is particularly attractive if you want to benefit from two types of coverage in one contract. You can convert your critical illness insurance to long-term care insurance at any time, while maintaining the same coverage amount.

However, not all insurers offer this option, and being able to convert your policy will usually result in an increase in your monthly premium.

That said, it is a practical possibility to know about, especially since this product is very popular with people aged 50 and over.

Is this an option that might suit you?

Can I speed up the payment of my critical illness insurance premiums?

Many people prefer not to spread the payment of their critical illness insurance over 20 years or more.

Many people want to have their insurance fully paid for upon retirement, or even before. This raises the question: is it possible to accelerate the payment of critical illness insurance premiums?

The answer is YES!

You can absolutely choose to pay your premiums more quickly, for example over 10 to 15 years.

Of course, this involves higher annual premiums, so it's important to assess whether this solution is truly beneficial for you.

Before committing to accelerated prepayment, we strongly recommend that you consult an insurance advisor or financial planner.

These professionals will be able to analyze your situation and determine, based on your needs and objectives, if this option is the best for you.

Is this a possibility that would interest you?

Difference between life insurance and critical illness insurance

Although their names are different and their main function is quite clear, some people sometimes confuse life insurance and critical illness insurance, and do not always fully understand how the benefits associated with each work.

To choose the protection best suited to your needs, it is therefore essential to understand how each type of insurance works.

The aim of this section is to explain to you simply and clearly the specificities of each, so that you can measure their respective usefulness.

LIFE INSURANCE

Life insurance provides protection in the event of death. Specifically, if you die, a lump sum will be paid to your beneficiaries, generally tax-free. This lump sum is not accessible to you during your lifetime. The primary goal of life insurance is to financially protect your loved ones, for example, by allowing them to repay any debts they may have or leave them an inheritance.

Critical illness insurance

Conversely, critical illness insurance covers you for the rest of your life. It kicks in if you're diagnosed with a serious illness. After a waiting period defined in your policy, you'll receive a lump sum directly, intended to compensate for a loss of income, cover your medical or other expenses, and prevent you from having to dip into your savings. For example, it can pay you a lump sum, such as $50,000, to help you get through this ordeal more peacefully.

The 25 most common serious illnesses in Quebec

#1 : Cancer

Cancer is a disease, also known as carcinoma, that is the abnormal or malignant growth of cells in the human body, which attack and destroy healthy tissue. Critical illness insurance normally covers all types of cancer, whether:

- Leukemia

- Lymphomas

- Hodgkin's disease

- HIV

- Tumors

- Melanomas

- Sarcoma

- Etc.

Some non-critical and less serious types of cancer are not always covered by critical illness insurance, such as in situ cervical cancer. For insurance to recognize cancer, the insured must have received a formal tumor diagnosis from a doctor. The waiting (survival) period before receiving the capital from critical illness insurance in the case of cancer can be up to 90 days.

#2: Stroke

A stroke occurs when blood flow to the brain is significantly reduced due to a blood clot, blockage, or hemorrhage. A stroke typically causes permanent damage to the brain and can even affect certain functions later on. Depending on the part of the brain affected by the stroke, it can cause partial paralysis, impaired vision or speech, etc. For a critical illness life insurance policy to pay out the capital following a stroke, there must be a formal diagnosis explaining that the incident was caused by thrombosis, intracranial hemorrhage, or extracranial embolism. The survival period before receiving the capital is generally 30 days.

#3: Heart Attack

A heart attack (also known as a myocardial infarction or coronary thrombosis) usually occurs when a clot blocks an artery in the heart, blocking blood flow to the heart. A heart attack can lead to death, but it can also cause the death of part of the heart muscle if the patient survives. To receive the benefit following a heart attack, the insured must survive for 30 days after the onset of the illness.

#4: Coma

Coma may also be covered by critical illness insurance and is generally defined as a loss of consciousness with no response to external stimuli or internal needs for a period of at least 96 hours. Comas resulting from drug or alcohol abuse, or those induced medically, are often not covered by critical illness insurance.

#5: Severe burns at 3e E degree

Severe burns may also be covered. Severe burns are considered when a formal diagnosis establishes that you have burns to the 3e degree on at least 20% of your body surface. Obviously, this diagnosis must be made by a professional.

#6: Aplastic anemia

This is a chronic, persistent bone marrow failure that can lead to neutropenia, anemia, and thrombocytopenia. This will require a blood transfusion and one of the following treatments: bone marrow transplantation, bone marrow stimulation, and immunosuppression.

#7: Blindness (loss of sight)

Blindness is defined as the total and irreversible loss of sight in both eyes. A specialist must then certify that:

- Corrected visual acuity is 20/200 for both eyes

OR

- The visual field is less than 20 degrees for both eyes

#8: Aortic Surgery

This is a surgical procedure that primarily treats aortic disease by removing and replacing part of the aorta with a graft. The term "aorta" includes the thoracic and abdominal aorta, but does not include branches of the aorta. To receive the benefit covered by critical illness insurance, the insured must survive at least 30 days after surgery.

#9: Vital organ failure and waiting list

Critical illness insurance may also cover the failure of any of the following vital organs:

- The heart

- Both lungs

- The liver

- Both kidneys

- Bone marrow

To be covered, the insured must not only experience a failure, but also be on a waiting list for a transplant in a recognized transplant program in Canada or the United States. The diagnosis of failure must be made by a specialist and it is important to find out the conditions that apply with your insurer to be sure you have the right protection.

#10: Dementia and Alzheimer's

Dementia and Alzheimer's are defined as the progressive deterioration of memory, as well as a cognitive disturbance (at least one) among the following:

- Agnosia, or difficulty recognizing objects

- Aphasia, or difficulty speaking

- Apraxia, or difficulty performing everyday tasks

- Inability to perform executive functions that affect daily life

Many conditions may apply in a critical illness insurance contract regarding this illness, so take the time to discuss them with your insurer.

#11: Benign brain tumor

A benign brain tumor is a non-malignant tumor found in the skull and limited to the brain, meninges, cranial nerves, or pituitary gland. Diagnosis of a benign brain tumor often requires surgery or even radiation therapy, which can cause irreversible neurological deficits.

#12: Multiple Sclerosis

Multiple sclerosis is a complex disease of the nervous system. A diagnosis must demonstrate at least two clinical episodes of disseminated demyelinating plaques, or abnormalities persisting for 6 months, or finally disseminated demyelinating plaques appearing at intervals.

This more complex disease is subject to many conditions, and you would be well advised to speak with your insurer if you want to know the exact conditions included in your contract.

#13: Loss of limbs

Critical illness insurance can cover the loss of limbs, but there are conditions. Generally, there must be a diagnosis establishing that, following an accident, the insured has suffered the complete separation of two limbs (feet or hands), starting at the wrist or ankle. Limb loss can also be due to amputation when medically necessary.

#14: Deafness (hearing loss)

Deafness occurs when the insured suffers a total and irreversible loss of hearing in BOTH ears. The hearing threshold must be 90 decibels or more within a speech intensity threshold of 500 to 3000 hertz. In short, the deafness must be complete and irreversible to qualify for a claim.

#15: Heart Valve Repair or Replacement

This is a surgical procedure that replaces a heart valve with a new natural or mechanical valve. The procedure can also correct defects and abnormalities in a heart valve. To be eligible for a claim, the surgery must have been deemed medically necessary by a specialist and the insured must survive 30 days after surgery.

#16: Coronary artery bypass surgery

This is a surgical procedure that essentially aims to correct the obstruction or narrowing of one or more coronary arteries by one or more grafts. Again, the surgery must be deemed medically necessary and the insured must survive 30 days after surgery to obtain the capital from their critical illness insurance.

#17: Vital organ transplant

Following failure of a vital organ, surgery may be necessary to transplant a new organ from among the following:

- heart

- Two lungs

- Liver

- Bone marrow

- Two kidneys

In order to be eligible for the critical illness insurance coverage capital, the insured must receive a transplant of one of these organs.

#18: Motor neuron diseases

There are several motor neuron diseases that can be covered by critical illness insurance in Quebec. Here is a list of the main ones that are covered by insurers:

- Primary lateral sclerosis

- Pseudobulbar palsy

- Progressive muscular atrophy

- Progressive bulbar palsy

- Amyotrophic lateral sclerosis (ALS/Lou Gehrig's disease)

#19: HIV infection in the workplace

HIV may be covered under some critical illness insurance policies when the illness is contracted at work through an accident resulting in accidental injury that exposed the insured to HIV-contaminated fluids.

Obviously, this is not a very common illness, but it is on the lists of many insurers in Quebec, and it is therefore important to mention it.

#20: Purulent meningitis

Meningitis is characterized by the formation of cerebrospinal fluid and the growth of pathogenic bacteria, leading to neurological impairment. Insurers often distinguish between purulent meningitis and viral meningitis, and do not cover the latter. Purulent meningitis often requires documentation by a specialist for a period of 90 days following the date of diagnosis, so it is a complex disease that attacks the meninges and can have serious consequences.

#21: Kidney failure

It is a chronic failure of both kidneys requiring regular hemodialysis, peritoneal dialysis, or a kidney transplant. It is a serious disease that must be diagnosed by a specialist.

#22: Paralysis

Paralysis is generally defined as the complete loss of muscle function in at least two limbs of the body as a result of injury or disease. The period of loss of control of muscle function in the limbs must be at least 90 days after the accident or event that gave rise to the diagnosis.

#23: Parkinson's disease

Parkinson's disease is a lifelong neurological disorder characterized by bradykinesia (slow movements) and at least one of the following symptoms:

- Muscle rigidity

- Tremors at rest

Parkinson's syndrome may also be covered by critical illness insurance. Check with your insurer for details.

#24: Loss of autonomy

An official and formal diagnosis of loss of autonomy indicates a total inability of the insured to carry out at least 2 of the 6 daily activities presented below, for a period of at least 90 days without reasonable hope of recovery.

The 6 daily activities generally stated:

- Feed yourself

- Wash

- Get dressed

- Get dressed

- Bouger normalement

- Continence control

A person should normally be able to perform these 6 activities: eating, washing, dressing, using the toilet, getting out of bed, moving normally, and controlling urination and bowel movements. If a person becomes unable to perform 2 of these 6 activities, they may be diagnosed as having a loss of autonomy. Some critical illness insurance policies cover this condition.

#25: Loss of speech

This is the total and irreversible loss of speech, that is, the ability to speak and make sounds as a result of injury, accident, or illness. The period must be 180 days for the diagnosis of speech loss to take effect normally.

Obviously, some contracts may vary this period, but a specialist must always provide an official diagnosis stating that the insured has indeed lost the ability to speak.

Survival rates for critical illnesses are increasing in Canada

According to statistics dating back to 2008, it was estimated that 60% of Canadians diagnosed with cancer would survive 5 years or more after receiving their diagnosis.

Since then, despite the fact that cancer seems to affect more and more people, survival rates have been increasing positively every year.

Already between 1992 and 2008, the survival rate for all cancers combined increased from 53% to 60% according to the Canadian Cancer SocietyCurrently, this rate is even higher and with the miracles of modern medicine, survival rates for most serious illnesses in Canada are likely to increase further in the coming years.

That's why it's more important than ever to have critical illness insurance that will get you through the illness and out of it without having squandered all your savings trying to survive while your employment income was lacking.

2 in 5 Canadians will be affected by cancer during their lifetime

According to the Canadian Cancer Society, nearly one in two Canadians will develop cancer during their lifetime, with an estimated probability of 45% for women and 49% for men.

This high statistic explains why cancer is one of the most discussed diseases in 2019.

Furthermore, in 2012, it was estimated that one in four Canadians would die from cancer (28% of men and 24% of women).

We note that men have a slightly higher risk than women. Here are some other key figures regarding cancer in Canada.

Some statistics on cancer (Canadian Cancer Society)

The Canadian Cancer Society released new data in 2017, including:

In 2017, approximately 103,100 men were diagnosed with cancer, with 42,600 deaths related to the disease.

For women, 103,200 cancer diagnoses were made, with 38,200 deaths.

On average, 565 Canadians learn they have cancer every day.

Every day, on average, 221 Canadians die from cancer.

Every day, on average, 221 Canadians die from cancer.

Prostate cancer accounts for 21% of new cases in men.

Lung cancer accounts for 14% of all new diagnoses.

The number of diagnoses is increasing, but survival rates are also improving.

Statistics on deaths from critical illnesses in Canada

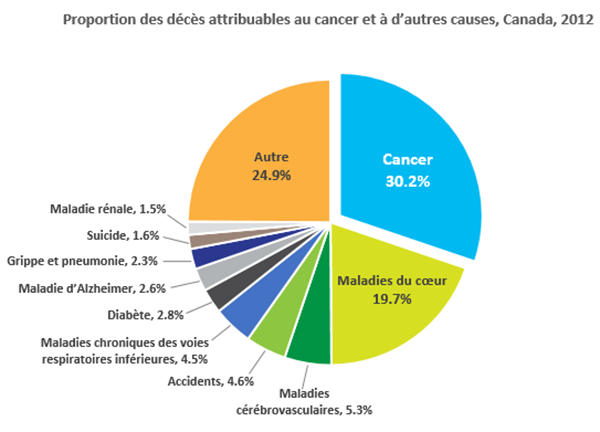

Many Canadians still underestimate the impact of serious illnesses on the causes of death. According to a 2012 graph from the Canadian Cancer Society, cancer alone accounts for 30.2% of deaths. When combined with cardiovascular disease, these two conditions account for approximately half of all deaths in Canada.

Other serious illnesses account for about 25% of deaths, while the remainder come from other causes.

Overall, critical illnesses account for approximately 75% of deaths in the country. Despite this, medical advances have improved survival rates for many of these illnesses, and having good insurance can provide valuable short- and long-term protection against these risks.

In Canada, someone has a stroke every 7 minutes.

Strokes are a major cause of death in the country, but survival rates remain encouraging.

According to the Heart and Stroke Foundation, each year, approximately 165,000 Canadians are affected by a heart attack, cardiac arrest or stroke.

Regular physical activity is also recognized as one of the most effective ways to prevent these cardiovascular diseases.

With survival rates constantly improving, having insurance becomes even more crucial. This provides financial support to rest and recover before returning to normal life.

Did you know that half of all home foreclosures in Canada are related to critical illness?

According to the Canada Mortgage and Housing Corporation (CMHC), 50% of real estate seizures occur following a serious illness that has caused major financial upheaval in the household concerned.

If you still think the financial consequences of a health problem are minor, think again.

The loss of income of just one spouse, caused by a prolonged illness, can be enough to plunge a family into debt... even losing their home.

The CMHC figures are proof of this.

This is why many financial planners strongly advise families to take out a critical illness or disability insuranceAdequate coverage can make all the difference, protecting you against sudden loss of income and preventing your home from being repossessed by the bank.

Nearly 40% of Canadians would be unable to cover their bills in the event of a critical illness

This surprising and worrying figure highlights a troubling reality: a large proportion of Canadian households are underinsured. Critical illness insurance is therefore not a luxury, but a necessity.

In fact, if one spouse were to stop working due to a serious illness, 4 out of 10 Canadians would not be able to meet their financial obligations.

This situation is consistent with CMHC data, which reveals that nearly half of home foreclosures in Canada are related to a serious illness. An alarming and sobering statistic.

So, the question is: would you rather save a few dollars a month by forgoing insurance, at the risk of losing everything if something goes wrong? Or are you willing to invest a small monthly amount to protect your family and maintain your peace of mind?

Because good insurance is more than an expense—it’s essential protection.

Key data on the critical illness insurance market in Canada

Relevant statistics provide insight into the issues surrounding critical illness insurance in Canada. To shed light on this topic, we relied on a research report published in July 2012 by the Canadian Institute of Actuaries.

How many illnesses are typically covered by critical illness insurance in Canada?

To assess whether your policy provides adequate coverage, it is helpful to know the national average. According to the Munich Re. Personal Insurance Survey conducted in 2010, critical illness insurance policies cover, on average, 25 serious conditions.

However, this coverage can vary considerably: some contracts only include 3 diseases, while the most complete ones can cover up to 30.

Of course, the more illnesses a policy covers, the higher the premium will generally be. However, it is important to highlight the significant differences between the different types of contracts offered on the market.

What is the average amount of coverage for critical illness insurance in Canada?

And how much coverage can you get?

The maximum amount of critical illness insurance coverage in Canada can reach approximately 2 500 000 $, although this limit varies between insurers.

However, it is interesting to note that in 2009, the average amount of coverage was from 84 000 $This shows that the majority of Canadians opt for less protection than 100 000 $, an amount generally sufficient to cover 1 to 2 years of average salary.

At what age do Canadians typically purchase critical illness insurance?

And what is the ideal age to think about it?

Experts recommend considering critical illness insurance whenever you have significant financial responsibilities, such as buying a house or the birth of a child.

According to 2009 data, themiddle age of people who subscribed to this type of insurance was 34.5 years old.

Are critical illness insurance plans with premium refunds popular in Canada?

Some contracts include an option to recover the premiums paid if no claims are made during the entire term of coverage. This type of contract is quite popular.

According to a study conducted by Munich Re in 2010, 67 % of critical illness insurance sold in Canada included a premium refund option. In other words, 2 out of 3 contracts offered this possibility.

What are the most commonly reported critical illnesses in claims in Canada?

According to data from the Canadian Institute of Actuaries, based on a survey of Munich Re, the cancer represents the majority of critical illness insurance claims.

68 % claims related to cancer.

13 % were linked to a heart attack.

These figures are taken from the analysis of 4,700 complaints settled before 2009. This observation highlights not only the prevalence of cancer, but also the relevance of having coverage adapted to these major risks.

What is the waiting period (or survival period) in critical illness insurance?

When you buy critical illness insurance, you will frequently hear about waiting time, also called survival timeBut what exactly is it? And how long does it last?

In simple terms, this period corresponds to the number of days you owe survive after diagnosis of an illness covered by the contract before being able to receive the payment of the insured capital.

Generally, this period is 30 day for most illnesses. However, in some cases such as a cancer diagnosis, it can extend to 90 day.

In other words, you must remain alive during this period (30 or 90 days depending on the illness) for the insurer to pay the planned benefit.

This may seem surprising, but this operation is standardized by the majority of insurers. Nevertheless, Delivery times may vary from one company to another, this is why it is essential to compare offers before making your choice. The ideal is to consult at least three companies with the help of a broker to find insurance with the best value for money and the most advantageous waiting period.

Surviving a stroke or cancer: increasingly encouraging prospects

Data released in 2017 by the Heart and Stroke Foundation reveals an optimistic trend in survival rates for people with stroke and cancer in Canada.

When it comes to strokes, the numbers are impressive: 85% of Canadians survive a first stroke. Despite the severity and frequency of this condition, the vast majority of patients survive, which is very reassuring.

On the cancer side, according to the same source, the survival rate for all types of cancer combined reached 62% in 2017. This statistic is constantly increasing, even though the number of diagnoses continues to rise.

Taking out critical illness insurance can help you face these eventualities with peace of mind. If you are diagnosed, you could benefit from valuable financial support without having to worry about the financial consequences of the illness.

What factors influence the cost of critical illness insurance?

Do all insurance companies offer the same rates for a similar critical illness insurance policy? The answer is no!

In Quebec, several factors can affect the amount of your critical illness insurance premium. To better understand what can increase or decrease the cost of this coverage, here are the 8 main elements to consider:

The insurer

your age

Gender (male or female)

The amount of coverage chosen

Your lifestyle habits

Smoker or non-smoker

Family medical history

Additional options included in the contract

The first factor to consider is the insurer himself. Indeed, rates vary from one company to another, even for equivalent protections. It is therefore essential to shop around and compare offers to get the best premium.

Age also plays an important role: the older you are, the greater the risk of developing a serious illness, which is reflected in the cost of the premium. Similarly, men are generally at greater risk than women, which may result in a higher premium.

The amount of coverage chosen directly influences the cost of your insurance: the greater the protection, the higher the premium will be.

Your lifestyle habits are also taken into account. Regular consumption of alcohol or drugs can increase the premium. The smoking is particularly penalizing, because it considerably increases the risk of serious illnesses such as cancer.

In some cases, family medical history can also play a role, especially if you opt for a contract with significant coverage. Finally, additional options that you add to the contract (additional guarantees, assistance, etc.) also influence the final cost.

6 Common Myths About Critical Illness Insurance in Quebec

Now that you have a good understanding of how critical illness insurance works, it's time to shed light on some persistent myths about it.

Although it is recommended by many experts for its ability to cover real risk in an affordable manner, Critical illness insurance is often misunderstood.

Some people spread misconceptions, sometimes unintentionally. Others mistakenly believe they are already adequately protected, when in reality they have no specific coverage against serious illnesses.

So here is the 6 most widespread misconceptions about this type of insurance in Quebec. The goal? To help you see things clearly and avoid being influenced by what is said in office discussions or well-intentioned but erroneous advice.

#1: My group insurance at work already covers me

It's true that many employers offer group insurance. However, not all of them necessarily include critical illness coverage.

Even if you think you're covered, it's important to read your policy carefully. In reality, few group plans include critical illness insurance.

If you find that this protection is missing from your contract, it is strongly recommended that you take out additional personal insurance. This could cover expenses such as medication, home care, childcare, treatments, or even travel expenses.

Take the time to carefully check your current protection with your employer to avoid unpleasant surprises.

#2: All insurers offer the same prices

A common misconception is that prices are the same regardless of the insurer, which discourages comparison shopping. This is completely false!

When requesting quotes from different insurers, you will most likely notice price differences – sometimes slight, sometimes very significant.

The lesson? Shopping around for critical illness insurance often allows you to save money and find the best deal for your needs.

#3: Critical illness insurance is prohibitively expensive

Many people believe that this type of insurance is reserved for those with deep pockets. However, it is often much more affordable than you might think.

For example, according to an estimate by SSQ Insurance, a 35-year-old non-smoking woman could obtain $50,000 in coverage for less than $58 per month.

This cost remains reasonable compared to the benefit of receiving a tax-free sum if you suffer a critical illness. And depending on your profile and the insurer you choose, you could even pay less. Find out more!

#4: The Quebec health insurance plan covers all medications

Many people think that the public health system covers everything in the event of illness. This is not the case.

The public system only reimburses a portion of medications, and some treatments are not covered at all. You could therefore face significant out-of-pocket costs.

Critical illness insurance provides a sum of money that can be used to cover these additional expenses. Don't rely solely on the public plan: supplemental coverage can make all the difference if illness strikes.

#5: I am healthy, I will not get sick

It's natural to think positively and believe that illness won't affect us. But the reality is quite different.

Here are some key figures from the Canadian Cancer Society:

555 Canadians are diagnosed with cancer every day.

2 out of 5 Canadians will be affected by it during their lifetime.

1 in 12 adults lives with heart disease.

216 people die of cancer every day.

Even in good health, no one is immune. Prevention also means planning for the unexpected.

#6: I have savings, I will be able to cope with illness

Many people believe their savings will be enough to cover a serious illness. Unfortunately, the costs are often much higher than expected.

Between lost income, medications, treatments, travel, and other unexpected expenses, your savings could quickly dwindle.

And if these savings are intended for retirement, it could jeopardize your plans and delay your departure. Critical illness insurance would allow you to protect both your financial health and your future.

Find the critical illness insurance that suits you in just a few clicks!

Would you like to compare different critical illness insurance options online, with the support of an expert?

Fill out our free, no-obligation form now — we'll connect you with one of our trusted partners.

Our partners offer insurance without a medical exam and with guaranteed approval, even if you have a health history!

Why wait?

Answer a few simple questions and quickly discover the best coverage for your needs.

It’s the simplest, fastest and most efficient way to find quality critical illness insurance in Quebec.

Protect yourself today!

FAQ

Frequently asked questions

C’est une plateforme qui vous met en relation avec des courtiers en assurance pour comparer des offres d’assurance vie.

Vous remplissez un formulaire en ligne, un courtier vous contacte, puis vous comparez les offres pour choisir la meilleure.

Oui, le service est 100 % gratuit pour les clients et sans frais cachés.

Nous aidons à trouver les meilleures assurances vie temporaire, permanente, maladies graves et autres protections via nos courtiers partenaires.

Remplissez simplement le formulaire de demande de devis et un courtier vous contactera rapidement.

Oui, le courtier peut vous proposer différentes options de plusieurs assureurs.