life insurance canada

Disability or salary insurance

Our broker and advisor partners work with the most well-known insurers in Quebec (see list)

Do you want to protect your income in the event of disability, whether temporary or permanent?

According to the Institut de la statistique du Québec, the average hourly wage of a Quebec worker in 2017 was $24.23, or an average weekly income of $858.52. But what happens if this income is suddenly interrupted due to an accident or illness?

If the incident occurs at the workplace, the CNESST (Commission for Standards, Equity, Health and Safety at Work) will cover the associated costs until recovery. In the event of a road accident, it is the SAAQ (Quebec Automobile Insurance Company) which will cover the costs.

But if the disability results from another type of event not covered by these organizations, the employee could suffer a significant drop in income—unless they have adequate protection. This is where disability insurance, also called salary insurance : it pays monthly benefits to the affected person for a specified period.

According to The Press (publication of October 1, 2006), 6 out of 10 workers already benefit from this type of protection.

What exactly is disability insurance?

Have you ever imagined what would happen if, suddenly, an accident prevented you from working? How would you manage to support yourself and cover your living expenses without an income?

Disability insurance, also called salary insurance, is designed to protect you in such a situation. It offers you a income replacement if you become disabled and are unable to perform your job.

Depending on the coverage chosen, up to 60 to 70% of your usual income can be assured. This financial support allows you to maintain a decent standard of living during your period of disability.

Unlike government plans, which often offer coverage that is limited in time and amount, private disability insurance is designed to provide you with more durable and personalized protection.

But what do we mean by "disabled"? It all depends on the definition specific to your insurerSome policies only cover the inability to perform your current job, while others require that you cannot perform any job at all.

Disability insurance in Quebec: are you covered?

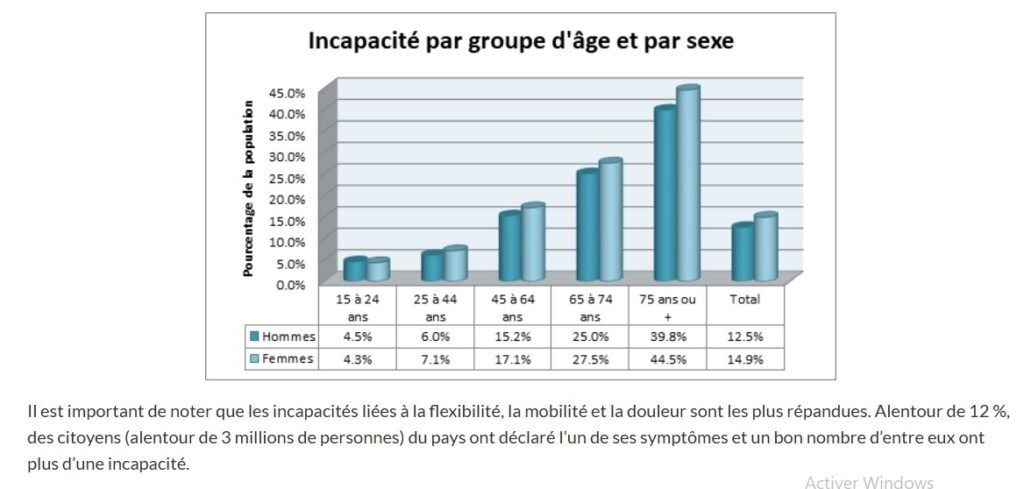

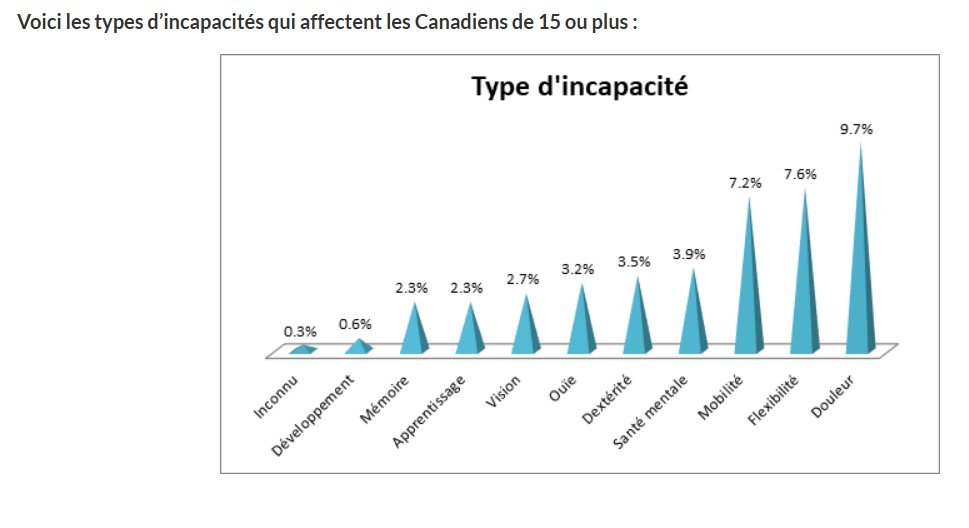

In Quebec, many financial advisors strongly recommend that their clients take out disability insurance. And for good reason: according to Statistics Canada, in a report published in 2012 (updated on February 15, 2017), 3.8 million Canadians aged 15 and over reported having a disability that limited their daily activities. This represents approximately 14 % of population !

In other words, disability is much more common than you might think. It's best to be prepared for the unexpected.

3,8 millions de personnes affirment vivre avec une incapacité qui restreint leurs activités quotidiennes !!

This publication also reveals that the onset of disability generally occurs in the early forties, with an average age of 43. Men are affected a little earlier, at an average age of 41.5, compared to 44.5 for women. However, women are more likely to report disability than men, with a rate of 15% compared to 13%.

The graph below illustrates the prevalence of disability by age and gender.

What if you suddenly become disabled? Ask yourself these essential questions:

✥ How will you provide for your family?

✥ What will happen to your debts and personal loans?

✥ Who will pay the rent or mortgage?

✥ Who will take care of paying the current bills like electricity, telephone, etc.?

Disability insurance, also called salary insurance, is a solution adopted by more than half of Quebecers. Some people have access to it through a group plan offered by their professional or student association.

If you have salary insurance through your employer, take the time to consult your contract to find out the your income replacement rate. Generally, group disability insurance covers between 60% and 85% of your taxable salary.

Also pay attention to the duration of services indicated in your policy: very often, financial protection only extends to a maximum period of 24 months.

Your group disability insurance will typically cover between 60% and 85% of your taxable salary and will protect you for only 24 months

Is your financial protection sufficient? Otherwise, take the time to assess your needs and put in place the necessary measures to secure your financial future.

✓ If your group disability insurance does not adequately cover loss of income in the event of temporary or permanent disability, consider purchasing individual disability insurance.

✓ If your employer does not offer any salary insurance, individual disability insurance is even more essential.

✓ Are you self-employed, a small business owner, or a partner in a corporation? Don't risk losing everything. Income protection insurance can give you peace of mind and protect your financial stability.

How to choose the best disability insurance? Which coverage should you choose?

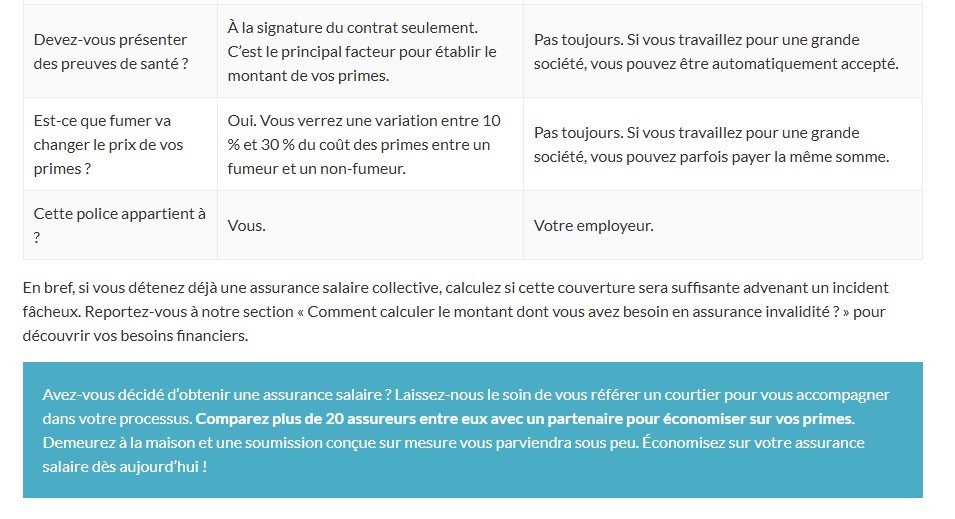

There are many companies offering disability insurance. But how do you know which one will truly meet your needs? With the free price comparison tool available on this page, you can compare offers from over 20 insurers without leaving your home. In just a few minutes, you'll receive a personalized quote from a partner broker, tailored to your situation.

Disability insurance or salary insurance: how does it work?

In the event of illness or accident preventing you from working, disability insurance—also known as salary insurance—steps in by providing you with replacement income. These monthly benefits are paid for a specified period, depending on your policy.

Martin Drapeau, financial security advisor and financial planner, insists: “Everyone should have disability insurance.”

In an article published by The Press, we discover the testimony of Madeleine Bourque, 45, from Laval. Following a major depression that kept her away from work for nine months, she was able to count on her disability insurance to receive $1,500 per month. This invaluable assistance allowed her to continue paying her mortgage without dipping into her savings.

“…everyone should have disability insurance.”

— Martin Drapeau, financial security advisor and financial planner

Here is a list already prepared to make your work easier:

%

when

Restriction

Health

Definitions

Taxation

% :

➢ Start by asking what percentage of your salary will be covered by the benefit.

➢ What is the maximum amount (ceiling) provided?

➢ How does your disability insurance fit in with your other protections (e.g., group insurance, CNESST, etc.)?

When :

➢ When will benefits be paid?

➢ Is the waiting period the same in the event of disability linked to an illness rather than an accident?

➢ In the event of a relapse, does the waiting period apply again?

Restrictions:

➢ Are there any restrictions or exclusions, particularly regarding pre-existing illnesses?

➢ What types of illnesses or accidents are not covered?

health :

➢ Is coverage conditional on a prior medical examination?

➢ Is it necessary to provide medical documentation to modify certain conditions of the contract?

Définition :

➢ How does the contract define disability?

Taxation:

➢ Will contributions be cancelled in the event of disability?

➢ Will contributions paid after the accident be reimbursed?

Additional questions to ask about a group insurance plan:

Is it possible to cancel my group insurance plan at any time?

Am I covered for a fixed period?

If premiums are not guaranteed, what can I expect in terms of increased costs?

In the event of a strike or authorized leave, does my coverage remain in effect?

Can the group plan be converted to individual insurance without having to pass a medical examination?

Is the plan insured or is it a non-insured benefits plan (NABP) ?

Questions to consider for your individual disability insurance:

As a self-employed person, will your income tax insurance cover your business's deferred income tax?

Do you get discounts on your premiums if no claims are made for a certain period?

If you can still work, but at a reduced rate, will you still receive benefits?

Does your disability insurance offer savings options to help you achieve your financial goals?

Understanding the Basics of Disability Insurance

Before getting into the details, it is essential to clarify key terms such as:

salary insurance, disability insurance, mortgage disability insurance, etc.

While the vocabulary of disability insurance may seem straightforward, there are some nuances that need to be clarified. For example, if you're unsure about the role of disability insurance, it's important to clearly define its purpose and usefulness.

Definition of disability insurance / salary insurance:

Disability refers to a temporary or permanent inability to perform one's job due to an accident, a physical or psychological condition, or a degenerative disease. According to the law, it is a condition that prevents a person from meeting their basic needs.

However, the definition of the term “disability” may vary from one insurer to another. Here are two examples of criteria used:

The inability to perform the majority of the duties of your current job.

The inability to perform the duties of your occupation or any other job for which you may be qualified, based on your experience and training.

Concrete examples of disability situations:

A plumber has to take time off after a heart attack.

A person suffers from major depressive disorder following an emotional shock.

A painter breaks his arm while hiking in the mountains, preventing him from working for two months.

A customer service agent, weakened by chemotherapy treatments, can no longer concentrate.

A long convalescence is necessary after an accident during a camel ride.

An accountant's abilities have been impaired after a stroke, leaving him unable to handle numbers as he used to.

Salary insurance in summary

Disability insurance, also known as salary insurance, serves to replace an insured's income in the event of incapacity to work. It pays monthly benefits, the amount and duration of which (usually 2 to 5 years) are defined in the contract. This type of insurance is particularly suitable for entrepreneurs, self-employed workers, or employees who do not benefit from group disability insurance.

Mortgage Disability Insurance: What Does It Involve?

Mortgage disability insurance aims to protect you financially in the event of incapacity to work due to illness or accident. It covers your monthly mortgage payments during your period of disability. Typically, the insurance premium is calculated based on the remaining balance of your loan, making it proportional to the amount to be insured.

Car insurance in case of accident

If you're injured while driving, your car insurance may pay you benefits. Whether your insurance acts as the primary or secondary payer depends on the terms of your policy and how it coordinates with other sources, such as your health insurance plan or income replacement.

In some regions, particularly those that have adopted a no-fault insurance system, the rules are precise: you cannot choose the source of your compensation, except in the event of an exceptional or catastrophic situation.

Dismemberment insurance

Additional protection in the event of functional loss

Often offered as an option in some insurance policies, dismemberment coverage provides a lump sum in the event of partial or total loss of use of a limb, sight, or hearing. This coverage may also include funding for necessary adjustments to your home to adapt your environment to your new physical condition.

Credit insurance

Support in case of unforeseen events

Would you like your credit card payments covered if you become disabled? Mortgage disability insurance is a form of credit insurance. These days, many types of loans can be covered, including bank loans, car loans, and more. The duration of the benefits is clearly defined in your contract. This insurance helps ease your financial burden in the event of disability.

All these protections will be accessible via our form Available on this page. This quick-to-complete (less than two minutes) reference tool allows you to compare offers from more than 20 insurers without any obligation. You will receive a personalized quote based on the criteria you have chosen for your disability insurance.

Critical illness insurance: what does it consist of?

A diagnosis of a critical illness—such as cancer, heart disease, or a stroke—can have a major impact on your finances. Critical illness insurance pays you a lump sum to help cover unexpected expenses until you recover.

Although medical advances increase the chances of survival, the costs of travel, home adaptations, and other uncovered expenses can quickly add up. The insured amount can vary between 25 000 $ and 2 500 000 $, depending on the contract chosen.

To receive this compensation, however, you must respect a survival time specified in the insurance policy. Payment is made once this period has elapsed.

Why take out critical illness insurance in Quebec?

Home support : to ease the burden on your loved ones during your convalescence.

Income replacement : it can compensate for the loss of household income, including that of your spouse.

Reduced financial stress : it covers debts and secondary costs during treatments.

Access to uncovered treatments : certain medications or alternative treatments are not covered by public or private plans.

An article from Montreal Journal (November 8, 2017) pointed out that the majority of group insurances only cover one or two years of salary. Is this enough to continue paying your mortgage? Also, if you lose your job, you also lose this coverage. There is a possibility of convert this insurance into an individual policy within one month of the end of your employment contract, but this often results in a significant increase in premiums.

A word of advice: anticipate your needs

Discuss your situation with a financial advisor. Also, find out about your family's medical history. If you are adopted or do not have access to this information, you may opt for a predictive DNA testAccording to RMC, these tests have been available over the counter in the United States since 2017 and cost on average between 200 $ and 500 $They allow us to assess your risks of developing certain hereditary diseases.

While we wait for science to correct the defects in the genome, prevention is better than cure!

Long-term care insurance

Who is long-term care insurance for?

Since 2017, the likelihood of reaching age 100 has never been higher. This means that many years of life could require hospital stays to treat various health issues. Long-term care insurance offers you the option of receiving care at home or in the long-term care facility of your choice. This coverage provides tax-free benefits, without requiring you to provide supporting documentation. In the event of a loss of independence or cognitive impairment, it relieves you of the financial burden of hiring the necessary assistance.

This protection is useful at any age, as disability can occur at any time. Have you considered your income if you suddenly become disabled? Even if disability insurance pays benefits, have you considered the costs of long-term care or specialized care that you may have to cover for an extended period?

According to the Canadian Life and Health Insurance Association (CLHIA) in its “Guide to Long-Term Care Insurance”:

$1.2 billion will be spent on long-term care for baby boomers over the next 35 years, only half of which will be covered by governments.

In 19 years, 25% of the Canadian population will be over 65, and one million Canadians will be affected by some form of dementia.

74% of Canadians do not have a financial plan to cover their long-term care in retirement.

Average monthly costs for residential accommodation range from $900 to $5,000, depending on public support received and the type of room chosen (private or semi-private).

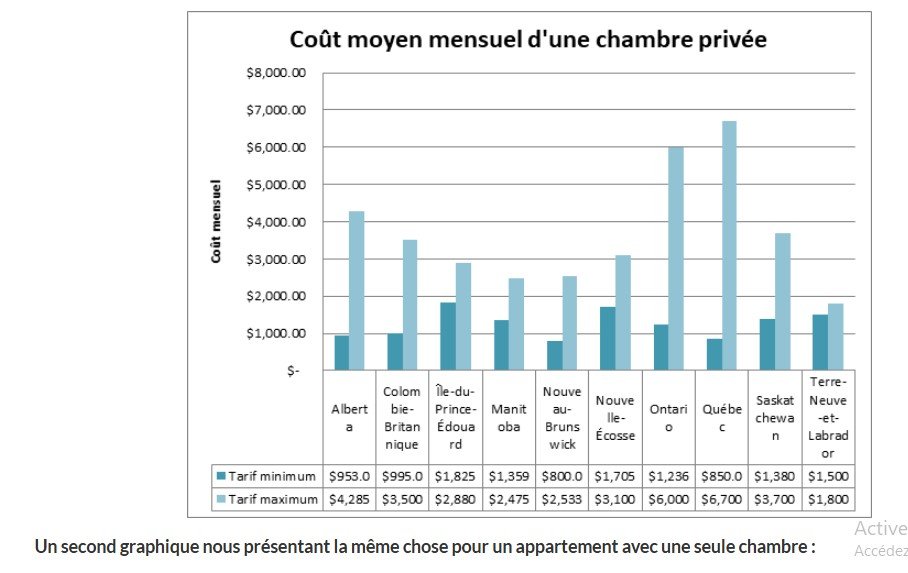

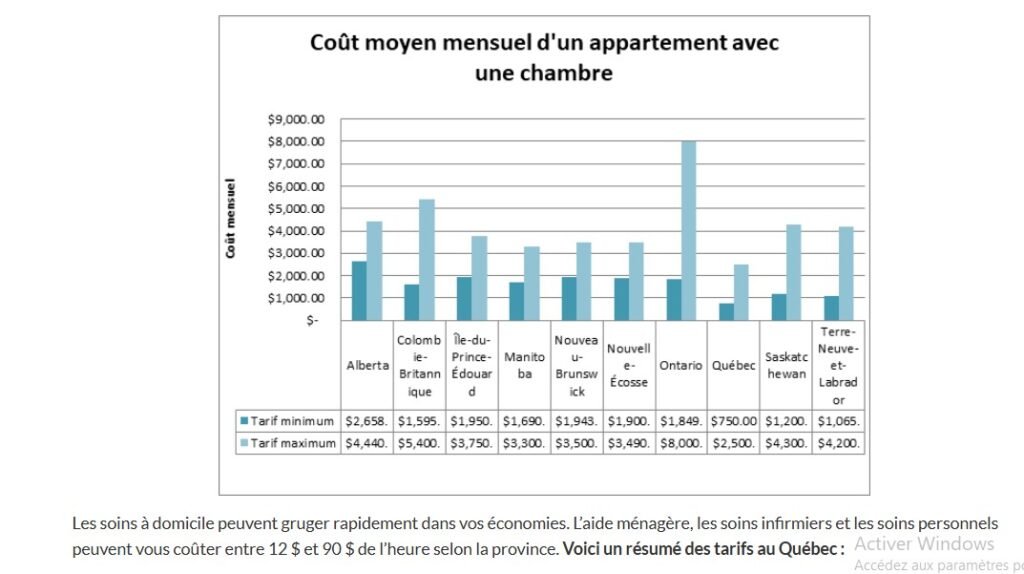

In Quebec, many people are unaware of the costs associated with retirement homes, especially in unsubsidized facilities. Here are the average costs of a private room by province in Canada, according to data from Lifestagecare:

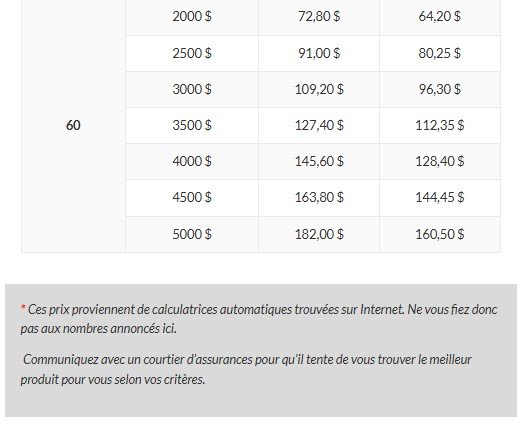

The costs associated with long-term care can quickly reduce your cash flow and eat into your savings. For example, if you currently had to pay $45 per hour for in-home care, for 3 hours per day, 5 days per week, your annual expenses would exceed $35,000.

In another case, if you choose to reside in a long-term care facility because you can no longer manage your home, with a rate of $4,000 per month, your costs would amount to $48,000 per year.

Unless they have a substantial financial cushion, it is clear that, in just a few years, the majority of Quebec households would not be able to afford such outlays.

Travel insurance

When does travel insurance protect you?

In Quebec, as in the rest of the country, care received in a hospital or public clinic is covered by your health insurance plan, with no direct costs for you. But what happens if something unexpected happens abroad? Travel insurance protects you against unpleasant surprises during your stay outside Canada. Indeed, medical care costs vary greatly depending on the destination, and hospital bills can easily reach several thousand dollars!

In the event of trip cancellation, theft or loss of luggage, or even for the repatriation of your remains in the event of death, travel insurance can significantly limit expenses (be sure to check the guarantees included in your contract).

insurance life

When does life insurance cost you nothing?

Some policies offer a premium waiver in the event of disability, which suspends payments while maintaining your coverage if the condition lasts more than six months. Many insurers also offer benefits for terminally ill policyholders, and some cover certain non-terminal critical illnesses. With group insurance, premium payments may be waived if your long-term disability benefits are approved, provided both policies are with the same company. In any case, don't hesitate to consult your insurer for details specific to your coverage.

To learn more about life insurance, see our article entitled “Why take out life insurance before age 30 in Quebec?”

Ten essential questions about disability insurance

We'll cover nine key disability insurance issues in more detail later. Before we do that, it's important to know that disability insurance can come from a variety of sources, including:

Individual insurance taken out personally

Government plans

Group plans offered by certain employers, unions or associations

Specific insurance, such as car, mutilation or critical illness insurance

How to determine the amount of disability insurance you need?

Several factors come into play when assessing the amount needed in the event of disability. Before making this estimate, take the time to answer the following six fundamental questions, as well as their sub-questions:

What are your current financial resources?

What is your salary?

What percentage of this salary is essential?

Do you have any financial investments?

Do you have enough cash to support yourself for a while?

What are your family responsibilities?

Do you have any obligations as a parent or guardian?

How many people depend on your income?

What are your debts?

Who will pay your car loan if you become disabled?

Who will take over the mortgage on your home in this case?

How long could you pay off your debts with your savings?

What is your current monthly expenses?

How much do you need to cover your needs each month?

Would you be willing to reduce your standard of living if necessary?

Would you be able to change careers easily?

Would you quickly find another job in your field?

Would you quickly find another job in your field?

What are your plans for the future and are they flexible?

What will happen to your retirement plan in the event of disability?

Could you easily give up certain family or personal projects?

Could you easily give up certain family or personal projects?

To determine a precise amount for your disability insurance, you will need to provide three documents (or three worksheets).

Document 1: Assessment of your needs

Gather all your lifestyle expenses in the first column. For annual expenses, divide them by 12 and enter them as well (don't forget to include any major renovations that can't be postponed, if you're planning any).

In a column on the right, list only essential expenses. Don't eliminate everything: Some people tend to eliminate all housing-related expenses, but be careful. In the event of a disability, additional expenses may be required to adapt your home.

Then add up these essential expenses. This total corresponds to your actual needs.

Document 2: Current protection

List your existing coverages (e.g., group salary insurance, disability insurance through your professional association, etc.) in one column.

On the right, indicate the average benefit amount you should receive. Keep in mind that these amounts combine but cannot exceed 85% of your regular salary.

Add these amounts together to get your current disability coverage total.

Document 3: Other sources of income

In one column, list your other income (dividends, universal life insurance payments, etc.).

In the next column, write down the estimated amount of each of these incomes.

Add up these additional sources, which will adjust your needs.

Finally, compare your coverage level to your expenses to determine your actual disability insurance needs. For an accurate analysis, it's recommended that you present these documents to a financial professional, such as a financial security advisor, life insurance broker, or financial planner.

You're facing a dilemma: you know your disability insurance needs, but you want to get an idea of the rates to better analyze the market. Take advantage of our free platform available on this page. (filling out the form will only take two minutes)By comparing more than 20 insurers through our partner broker, you'll receive a personalized offer tailored to your situation. Optimize your protection while saving money.

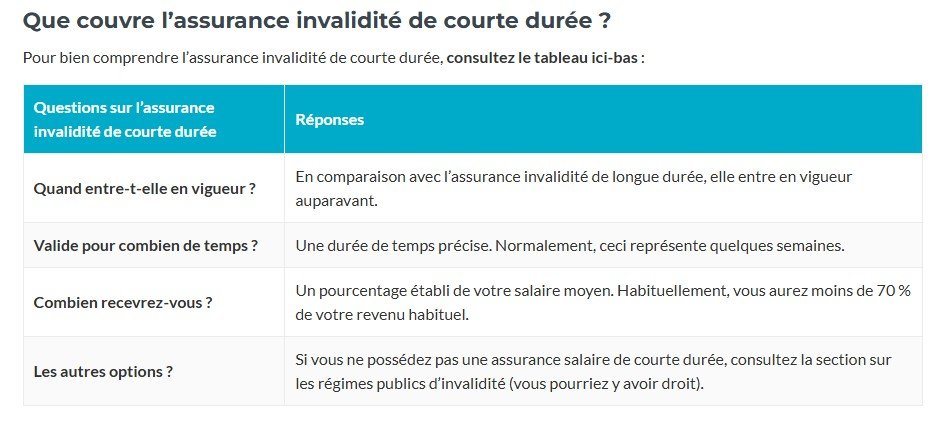

How much does salary insurance cost in Quebec?

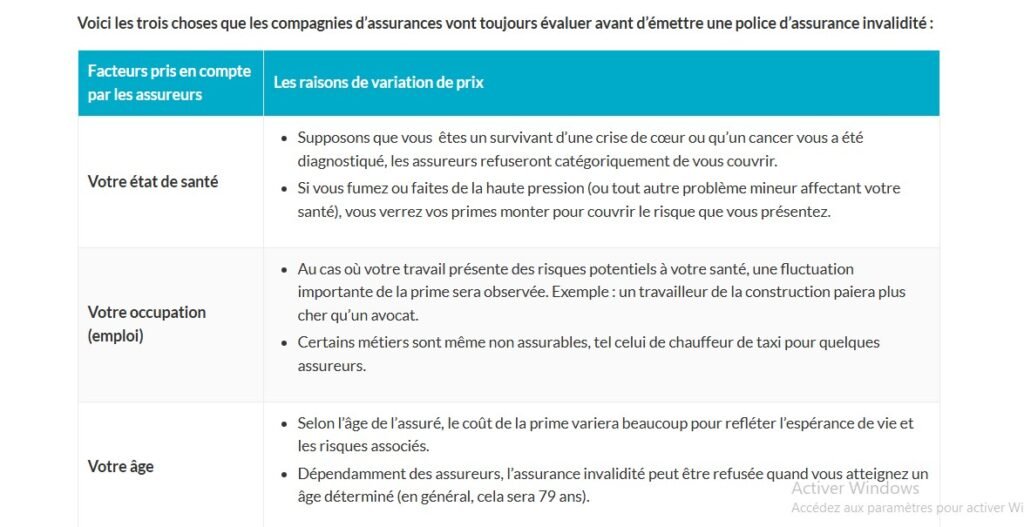

Generally, individual disability insurance offers a fixed premium until age 65. In contrast, the premium for group disability insurance varies based on the average age of the members of the company or association to which you belong, with an annual review. Several factors influence pricing, including:

The nature of your job (does your position present a high risk of injury?)

Your salary (an average of your income is taken into account)

Your smoking or non-smoking status

The average age of the group you belong to, according to your sector of activity

The type of salary insurance chosen (individual disability insurance is generally more expensive)

The length of the waiting period (some group policies do not allow this option to be modified)

The desired compensation period (the longer it is, the higher the premiums)

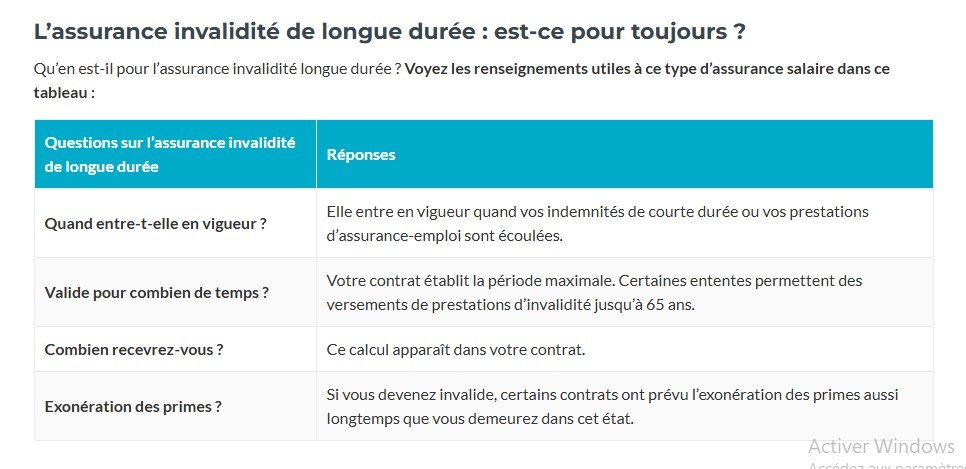

What is the waiting period for disability insurance?

The waiting period is the period that elapses after the onset of your disability before you begin receiving benefits. This period is specified in your insurance contract and can vary from one agreement to another, being shorter or longer. If you do not have a copy of your contract, do not hesitate to contact your insurer for this information. When signing up, you will have to choose a waiting period from several options: 30, 60, 90, or 120 days. If your financial situation is stable and you have a good cash reserve, it may be wise to opt for a longer period to reduce the amount of your premiums.

Also, be aware that many employers offer sick leave. If you plan to take advantage of it during this waiting period, inform your employer of your intention.

How is disability insurance benefits taxed?

Disability benefits paid by your insurer may be taxable. To determine your exact tax situation, it's best to contact your insurance company directly.

Am I protected by the state: what do you need to know about public disability schemes?

The website "L'Autorité" explained in an article on disability insurance that some public disability plans can provide you with benefits without requiring you to pay premiums to a private insurer. But are you eligible for these public plans? Sometimes, these benefits are in addition to those you already receive, but generally, your insurer will coordinate the amounts paid with those of the public plans. Thus, it will often adapt its financial support based on the compensation provided by these public disability plans.

Here are the main government programs that cover certain forms of disability:

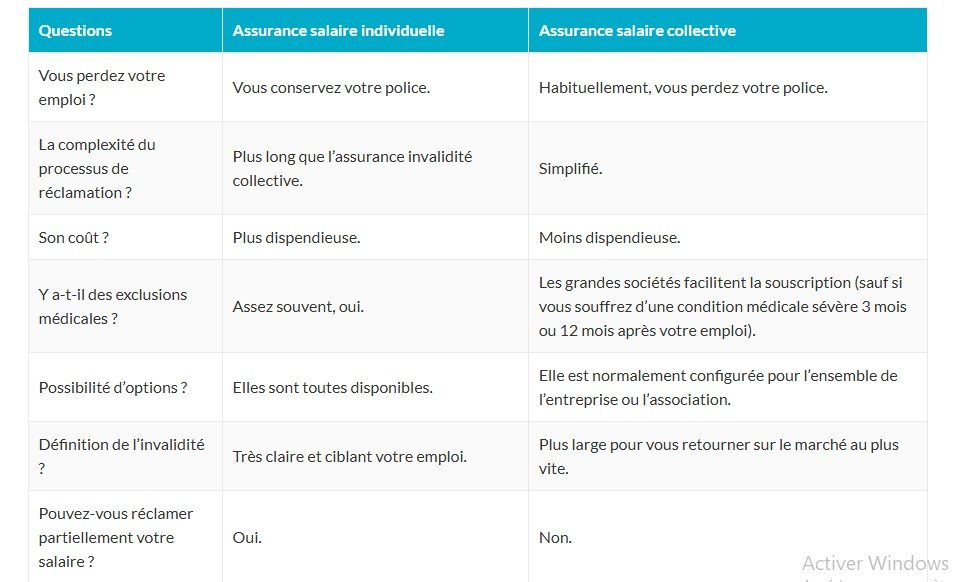

What is individual disability insurance?

Individual disability insurance is coverage purchased by a single person. It is particularly recommended for self-employed workers, who lack an external safety net in the event of loss of income. This insurance offers several advantages, including the ability to:

✓ Choose a coverage period suited to your financial situation.

✓ Set a waiting period to reduce the cost of your premiums.

✓ Maintain your protection even if you lose your job.

How to apply for individual disability insurance?

Your application will be carefully reviewed by the insurer. Once you complete and submit your form through an insurance broker, the information you provide will influence your future premiums. This information includes:

Your current profession.

Your income.

Your hobbies.

Your state of health.

Sometimes, a medical exam or additional documents may be requested. Don't worry, refusals are rare. In the event of special financial or medical conditions, an additional premium may be applied. If your occupation presents high risks, certain conditions may be adjusted, such as an extended waiting period or a reduced benefit payment period.

Is there a chance I will be refused if I have health problems?

Not necessarily. The insurability assessment takes several criteria into account. By remaining transparent with your broker, they will search for insurers that accept high-risk profiles. If you are rejected by most companies, ask your broker for alternative solutions, such as life insurance, which has different terms and conditions and may include additional protections.

What is group disability insurance?

Group disability insurance, often referred to as "disability insurance," is offered to members of an organization, whether it's a business, a professional association, or a public institution. Membership is generally mandatory, and coverage options are limited.

To enroll, you usually have to go through your employer or union. In large companies, employees are often not required to complete a medical questionnaire, which makes enrollment easier. However, smaller organizations may require a medical exam, and some employees may be denied coverage for health reasons. Sometimes, medical data is collected on all employees to assess overall risk.

Who decides whether your salary insurance is approved: your insurer or your doctor?

Contrary to popular belief in society, it is not the doctor who has the final say in recognizing disability status.

In reality, it is the insurance company, which holds the policy and is responsible for paying benefits, that makes the final decision. It uses all the information gathered during its investigation to assess your situation and determine whether you are eligible for the disability benefits provided for in your policy.

What to do if your disability insurance is refused?

Sometimes misunderstandings or inaccuracies arise between the insured and the insurer regarding a disability insurance claim. If you find yourself in this situation, the first step is to contact your insurance company to clarify the situation.

If, despite this, the company wrongly rejects your application and the situation becomes complicated, legal recourse is available. You can file a complaint with the Autorité des marchés financiers (AMF) via their website. An advisor at the information center will listen to you and guide you through the next steps.

How to choose among the different types of disability insurance contracts?

In Canada, nearly one million people have individual disability insurance (data provided by the Canadian Life and Health Insurance Association – CLHIA).

Having introduced the different types of disability insurance above, let's now look at their popularity, based on statistics from the 2015 edition of "Life and Personal Insurance Facts in Canada" published by the ACCAP.

Three types of salary insurance explained for you!

When looking for disability insurance in Quebec, you'll quickly realize there are several broad categories of policies. For optimal protection, individual disability insurance offers more detailed and flexible coverage. If you want to protect your personal finances and those of your family, it's essential to choose insurance that fully meets your needs.

Guaranteed Renewable Salary Insurance: What You Need to Know

With this type of contract, the insurer agrees to renew your salary insurance policy. However, it can increase premiums, but only if this increase affects an entire category of insured persons. Furthermore, the insurance company can adjust the terms of the contract, generally every 12 months.

Here are some examples of situations that may increase your premiums, or result in exclusions in your policy:

Losing your job or changing careers.

A worsening of your health condition.

An increase or decrease in your salary.

What does the term “exclusions” mean?

For example, if you suffer from back pain or are diagnosed with depression, the insurer will refuse to compensate you for loss of income related to these health problems.

What is non-cancellable disability insurance?

For the duration specified in your disability insurance contract, the insurer cannot cancel your policy or increase your premiums. This type of insurance is often referred to as "non-cancellable disability insurance with guaranteed renewal" or "irrevocable disability insurance."

Generally, the contract ends at age 65, making it one of the best forms of disability insurance coverage in Quebec. According to Claudine Cloutier, director of the Cloutier Group (a financial services firm), irrevocable disability insurance is "the Cadillac of disability insurance!" This coverage is more expensive, but thanks to its irrevocable nature, your policy protects you even if your income decreases or your health deteriorates. The benefits provided will then be maintained and paid according to the terms of the contract.

FAQ

Frequently asked questions

C’est une plateforme qui vous met en relation avec des courtiers en assurance pour comparer des offres d’assurance vie.

Vous remplissez un formulaire en ligne, un courtier vous contacte, puis vous comparez les offres pour choisir la meilleure.

Oui, le service est 100 % gratuit pour les clients et sans frais cachés.

Nous aidons à trouver les meilleures assurances vie temporaire, permanente, maladies graves et autres protections via nos courtiers partenaires.

Remplissez simplement le formulaire de demande de devis et un courtier vous contactera rapidement.

Oui, le courtier peut vous proposer différentes options de plusieurs assureurs.